The Fed used to suffer from the hall of mirrors problem and took its policy decisions based on the markets’ signals. In 2022, everything has changed. A drop in the stock indexes doesn’t discourage the US central bank. How does it affect EURUSD? Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

Financial markets were surprised by the Fed’s determination expressed at the press conference held by Jerome Powell after the FOMC January meeting. Unlike in 2015, when the central bank put off the date of the first federal funds rate hike due to problems in China, now it is not going to pay attention to either the omicron, or the collapse of US stock indexes, or a possible Russian invasion of Ukraine. The Open Market Committee intends to raise the rate at its meeting in March if conditions are created for this. That is all. The monetary restriction is to start!

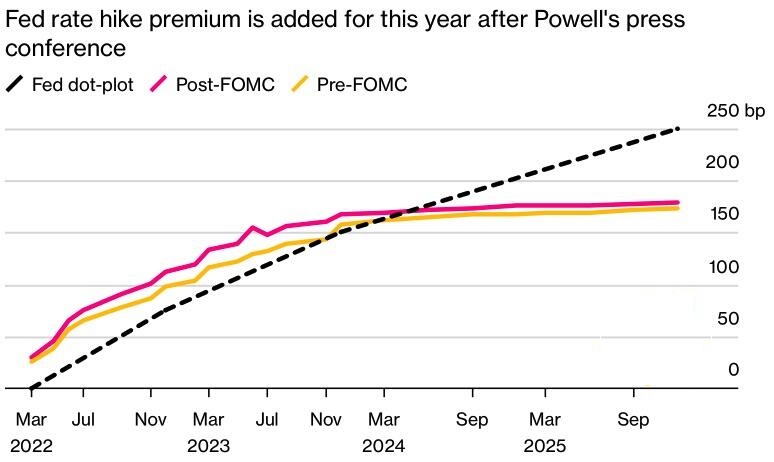

Powell said there is a risk that the current high inflation will last for a long time. There is a risk that it will go even higher. The Fed chairman noted that most FOMC members believe the labour market is in a state of full employment. It means a high level of employment combined with price stability. Powell is of the same opinion. High inflation and a strong labour market are exactly the conditions needed to raise the federal funds rate, so its rise in March is decided. At the same time, Powell’s speech, which JP Morgan called the most “hawkish” of all during his tenure as the Fed Chair, allowed derivatives to raise forecasts for borrowing costs growth by 115 basis points in 2022. If so, there are going to be more than four acts of monetary restriction.

Jerome Powell didn’t answer questions about whether to expect a 50-basis-point rate hike in March, which hasn’t happened since 2001, or whether the Fed will tighten monetary policy at every meeting, which hasn’t been seen since 2006. He said that the central bank should be humble but a bit nimble. After his speech, the derivatives market increased the probability of three rate hikes by June from 45% to 60%.

If the Fed intends to raise borrowing costs in March, May, and June, while inflation continues to be at a high level, nothing will stop the regulator from continuing the cycle in the second half of the year. Seven rate hikes could become a reality, but that’s an entirely different story for the US dollar. The dollar bulls expected three or four rate hikes, and here is such a surprise! The EURUSD has naturally dropped to the lower border of the trading range of 1.122-1.138, meeting my earlier forecasts of reaching the levels of 1.127 and 1.122.

Jerome Powell stressed that the main tool for fighting inflation is the federal funds rate. The Fed will decide on unwinding the balance sheet after the first rate hike. At the same time, the Fed believes that any reduction in its balance sheet — when and if that takes place — will mainly stem from simply not reinvesting maturing bonds rather than selling its holdings outright.

Weekly EURUSD trading plan today

Thus, the markets were convinced of the intention of the Fed to act aggressively, which resulted in falling stock indices and the fastest rally in the 2-year Treasury yield since March 2020. The US dollar has strengthened against a basket of major currencies. Unless the EURUSD consolidates at level 1.122, the downtrend is likely to continue towards 1.115 and 1.11.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.