Geopolitics makes a short-term impact on Forex, while monetary policy has a long-term effect. Nonetheless, the EURUSD features a stronger reaction to the conflict in Eastern Europe than to the Fed. Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

I believe, I do not believe. Russia announced the return of part of the troops from the border with Ukraine to the base, EURUSD rose. Washington did not believe Moscow and stunned investors with a message about an increase in the military contingent in the conflict zone by 7,000 people, the euro immediately fell against the US dollar. Vladimir Putin with the tanks seems to worry investors more than Jerome Powell with the interest rates.

Before the escalation of the conflict in Ukraine, 64% of investors surveyed by Bank of America called inflation and the related hawkish actions of central banks the main risk for financial markets, and only 7% of them named to the Russian-Ukraine confrontation. Now, economists’ views have changed. The S&P 500 surprisingly rose after the release of the minutes of the FOMC January meeting, according to which the Fed expressed its willingness to raise rates in March and tighten monetary policy faster than in the previous cycle.

In fact, stock buyers were afraid that the minutes would contain signals of a rate hike costs by 50 basis points in March or the Fed’s willingness to tighten monetary policy at every FOMC meeting. There was nothing of the kind in the document, and the stock index went up, not being afraid of the Fed’s hawkish surprise.

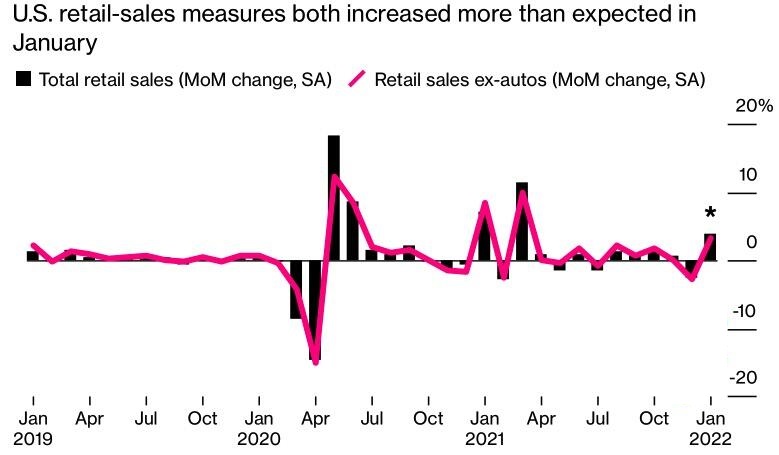

At first sight, the EURUSD downtrend must have been restored. The US retail sales grew by 3.8% M-o-M, the highest rate since March 2021, the industrial production increased by 0.2% M-o-M, and the employment is also strong. Therefore, the US GDP should feature strong growth as well. The euro-area area, in contrast, is in the energy crisis.

The CME derivatives give an 80% chance for the federal funds rate to rise to 2% by the end of 2022, which means a rate hike at every FOMC meeting this year. The ECB is concerned about widening the spread between the Italian and German bond yields to 1.7%, the widest since the summer of 2022; so, it will hardly tighten monetary policy aggressively. At best, the ECB will raise the deposit rate by 10 basis points.

Moreover, the USA accuses China of failing to fulfill its commitments under the trade deal of 2020. Washington is willing to take further steps to equalize the competitive conditions. The EURUSD bulls must be set back, as the euro was under pressure because of trade wars in 2017-2018.

Weekly EURUSD trading plan

However, I suppose Forex traders just play the “I believe, I do not believe” game. If there is no war in Ukraine, the euro should rise as the energy crises will ease. If the Fed doesn’t tighten monetary policy six or seven times in 2022, the US dollar will fall. The factor of the Fed’s aggressive monetary tightening has already been priced in the dollar quotes. If the Fed doesn’t act according to the derivatives market’s execrations, the EURUSD will be rising. Therefore, I recommend holding the longs entered in the zone of 1.13-1.1315.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.