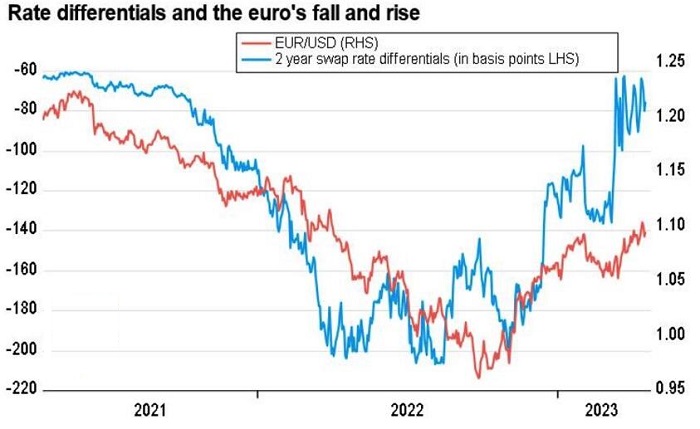

The narrowing of the US-German bond yield spread leads to an outflow of capital from the US to Europe and EURUSD growth. These processes are based on the divergence in the monetary policy of the ECB and the Fed. Let’s discuss this topic and make up a trading plan.

Weekly US dollar fundamental forecast

No matter how hard the US dollar tries to prove its worth, you can’t fight rates. UK inflation above 10% allowed the derivatives market to predict an increase in the interest rate from 4.25% to 5% by the BoE. Bloomberg experts expect the ECB to increase borrowing costs by another 75 bps to 3.75%. Even if the Fed holds the federal funds rate at a peak of 5.25% for a long time, this will not save the EURUSD bears.

Citi experts note that the banking turmoil in Europe has ended without much impact on the eurozone’s economic growth, which gives reason for the ECB hawks to call for higher rates. Based on the dynamics of the composite PMI, the eurozone GDP will expand above trend, while the industrial production in the first quarter will grow by 1.3% (the fastest rate since the end of 2021). In this regard, Citi revised its 2023 GDP forecast from 1% to 1.3%. It now expects an increase in the deposit rate to 4%. According to the company’s analysts, the deposit rate will remain there until mid-2024.

Member of the Executive Board Isabelle Schnabel cannot say what will happen at the next ECB meetings. Everything will be determined by the data. The record-high eurozone core inflation speaks for itself. Frankfurt intends to continue raising rates while the 10-year US-Germany yield differential (currently at its lowest level since April 2020) will narrow, and EURUSD will grow. The same applies to derivatives market instruments, in terms of which the euro is undervalued compared to the US dollar.

New York Fed President John Williams is confident that the central bank will take a restrictive view and keep it long enough to bring inflation down to a long-term target of 2%. According to the latest FOMC forecasts, this means that the federal funds rate will be raised to 5.25% and remain there until at least the end of 2023. Williams expects inflation to fall to 3.5% at the end of the year. At the same time, the target of 2% can be achieved next year.

In my opinion, the US dollar is still relevant. If US inflation accelerates unexpectedly, a recession doesn’t hit the US, or another major economy weakens, the greenback will immediately strike back.

Weekly EURUSD trading plan

Despite the bullish outlook for EURUSD in the medium and long term, anything can happen to the main currency pair in the short term. Be prepared to enter both long trades following a breakout of resistance at 1.098 and sell the euro against the US dollar in case of a successful breakout of support at 1.092.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.