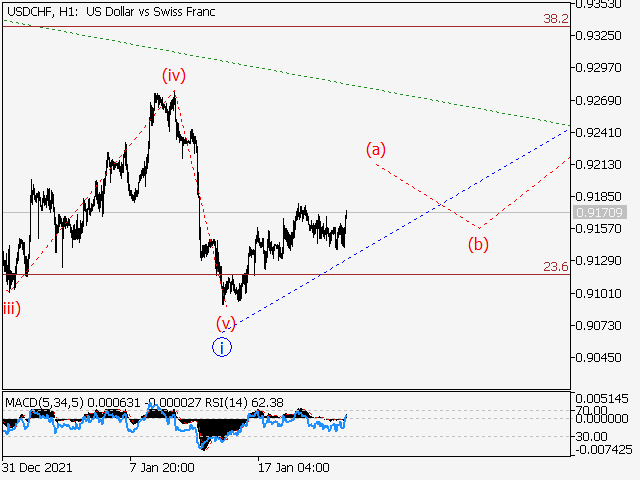

Main scenario: consider short positions from corrections below the level of 0.9374 with a target of 0.8924 – 0.8768 once a correction is completed.

Alternative scenario: breakout and consolidation above the level of 0.9374 will allow the pair to continue rising to the levels of 0.9506 – 0.9680.

Analysis: A descending first wave of larger degree (1) of 5 is formed on the daily chart, and a correction has presumably developed as the second wave (2) of 5, with wave C of (2) formed inside. Supposedly, the third descending wave (3) of 5 started developing on the H4 chart, with the first counter-trend wave of smaller degree i of 1 of (3) formed inside. Apparently, a local correction is forming as the second wave ii of 1 on the H1 chart, with wave (а) of ii developing inside. If the presumption is correct, the pair will continue to fall to the levels of 0.8924 – 0.8768 following the correction. The level of 0.9374 is critical in this scenario. Its breakout will allow the pair to continue rising to the levels of 0.9506 – 0.9680.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.