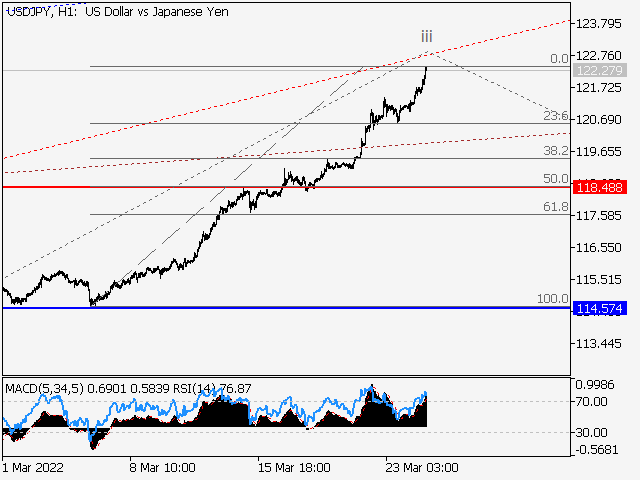

Main scenario: consider long positions from corrections above the level of 118.48 with a target of 124.50 – 126.00.

Alternative scenario: breakout and consolidation below the level of 118.48 will allow the pair to continue declining to the levels of 114.57 – 111.92.

Analysis: the third wave of larger degree 3 presumably continues developing on the daily chart, with wave iii of 3 forming as its part. The third wave of smaller degree (iii) of iii is formed, corrective wave (iv) of iii has finished developing, and the fifth wave (v) of iii is forming on the H4 chart. The third wave iii of (v) appears to have formed on the H1 chart. If this assumption is correct, the pair will continue to rise to 124.50 – 126.00 once a local correction iv of (v) is completed. The level of 118.48 is critical in this scenario as a breakout will enable the pair to continue declining to the levels of 114.57 – 111.92.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.