US stock market correction and the associated decline in the global risk appetite press down the Australian dollar. Is it a long-term trend? Let’s discuss this topic and make up a trading plan for the AUDNZD and AUDUSD.

Weekly Australian dollar fundamental forecast

No matter how strong you are, swimming against the tide will send you back. The Australian dollar was not supported by a strong report on Australia’s inflation and continued falling against the US dollar amid high volatility in financial markets ahead of the FOMC January meeting. When the risk appetite is down, high yields on local bonds will press the currency down.

Despite massive asset purchases by the RBA of AU$330 billion, Australia’s bond yields are elevated relative to other markets with AAA scores from all the major ratings companies. That is why the AUD can be called a risky currency, pressed down by the US stock market crash. Not surprisingly, the AUDUSD was jumping up and down on January 24, just like the US stock market.

Australia’s inflation surge to 2.6% in the fourth quarter should have encouraged the AUDUSD bulls. For the first time since 2014, the indicator exceeded the middle of the 2% -3% inflation range targeted by the Reserve Bank. Furthermore, Philip Lowe and his colleagues expected to only see CPI at 2.5% by the end of 2023. Most likely, such forecasts allowed them to stick to the position that RBA interest rates would not rise this year.

Inflation rise and a decline in unemployment to a 13-year low could make the RBA change the viewpoint. As a rule, a more hawkish tone of the central banks should strengthen the local currency. For example, the US dollar was affected by the change in the Fed’s views in the summer of 2021.

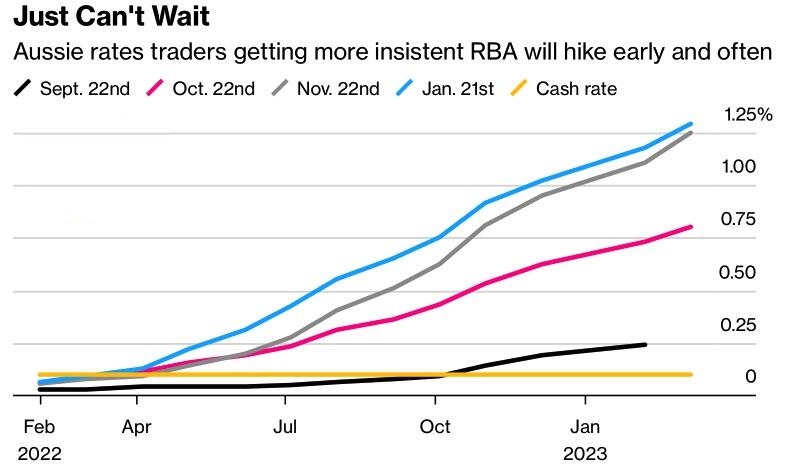

Currently, money markets predict the first cash rate hike in May, although Philip Lowe says that the monetary restriction start should not be expected before 2023. Capital Economics expects this to happen in November, AMP Limited is betting on August.

Thus, amid the inflation surge and Australia’s job market recovery, the RBA meeting on February 1 is really important. Investors expect the regulator to quit the QE and remove the wording that a cash rate increase in 2022 is unlikely.

Weekly AUDUSD and AUDNZD trading plan

Will the RBA’s monetary tightening this year strengthen the Aussie? It is a controversial question. Pessimists refer to the kiwi, falling down even though the RBNZ was one of the first issuers of G10 currencies to raise rates. Optimists, including myself, believe that the expectations of a cash rate hike are stronger than the hike itself. Therefore, I suggest considering AUDNZD purchases with targets at 1.081 and 1.087. The AUDUSD trend depends on whether level 0.715 will be broken up or down. If bulls don’t give in following the Fed’s meeting, they could go ahead with the expectations of the RBA’s hawkish stance at the meeting on February, 1.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.