The lower EURUSD falls, the more bearish forecasts. Nobody knows how deep the pair will fall. Analysts suggest level 0.98 and even 0.945. However, the situation could turn upside down if the Fed starts cutting the rates. Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

The euro is falling into the abyss, while Societe Generale calls it virtually unbuyable, and the world’s largest banks, together with the investment companies, suggest the parity of the single European currency and the US dollar. However, Reuters experts issue a median forecast for EURUSD at 1.1 in 12 months. Isn’t it a paradox? There is a growing belief that a recession will force the Fed to cut rates, despite the minutes of the FOMC June meeting read that the recession is the price the central bank is willing to pay for the victory over inflation.

Yes, every trader knows they should not go against the Fed, but the markets often test the central bank’s determination. The regulator often follows market signals. At the end of 2021, FOMC forecasts were for a very modest federal funds rate hike in 2022, investors demanded more and got their way! The Fed was not going to increase borrowing costs by 75 basis points in June, but CME derivatives actively pushed it to do so, and the result was not long in the coming. Just two reports, on inflation and inflation expectations, made Jerome Powell and his colleagues take a huge step.

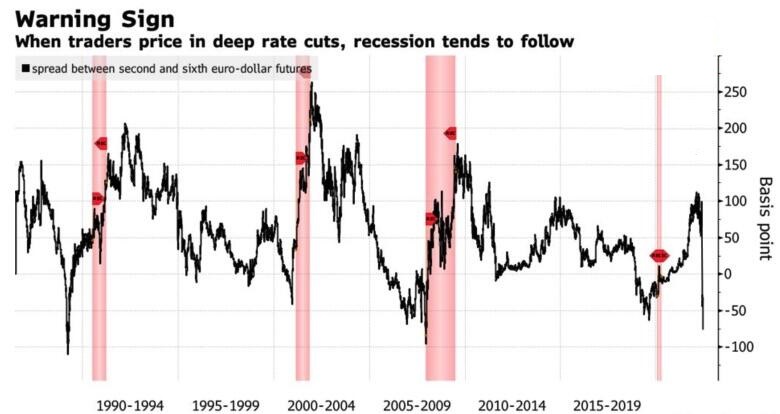

If the Fed has already changed its mind twice in the last six months, it might do it for the third time as well. Its latest forecast is for the rate to rise to 3.8% in 2023, but the futures market sees a peak of 3.2% with a subsequent decline to 2.7%. Historically, if the derivatives market expected the borrowing costs to decline by 40 basis points or more, the US economy slipped into recession.

However, those who make forecasts for the US dollar based solely on Fed rates can pay a heavy price. The greenback is also a safe-haven asset, and the US economy, even during a recession, can look better than others, especially the euro area. Societe Generale believes that Europe’s energy dependence on Russian energy supplies is still strong, and the gas shutdown will result in a EURUSD drop by another 10%. Nomura expects the pair to drop to 0.98 by August, and ING suggests a fall to 0.9545 over the next four weeks.

Citi blames the ECB for the euro downtrend. To curb inflation and support the value of the regional currency, the ECB must quickly raise rates and come up with an effective mechanism to prevent fragmentation. But the regulator does not have a clear plan. Judging by the latest officials’ speeches, policymakers have many doubts and disagreements. Investors expect clues from the Governing Council June meeting’s minutes, but even the hawkish stance will hardly support the EURUSD.

Weekly EURUSD trading plan

I believe if the euro breaks out the resistance at $1.022, it could rise to $1.0245 and $1.028, where sellers will go ahead. Ahead of the US jobs report, the pair could also be consolidating. I recommend trading with small targets.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.