Will the Fed stop the banking crisis in the US? Maybe the US central bank will consider that there is nothing to be afraid of, like the ECB and the OECD. That now is not 2008, that there was no Armageddon. Let’s discuss this topic and make up a trading plan for EURUSD.

Weekly Euro fundamental forecast

The financial world has gone crazy. Markets are trading as if Armageddon has already arrived, banks in the US, Europe and Japan lost $459 billion of their value in March, and global investors believe that a recession will not come. The OECD calls on the Fed to raise the federal funds rate to 5.5% and the ECB to raise the deposit rate to 3.75%. The Organization notes that this is not 2008. Yes, but 15 years ago there was no such high inflation.

The bankruptcy of three US credit institutions at once and the provision of assistance to the First Republic by large banks indicate serious problems in the system. The “contagion” is spreading around the world, and sinking Credit Suisse has to buy UBS for $3 billion. The Swiss government will compensate the new owner for $9 billion of possible losses, and SNB will provide $100 billion in liquidity. Europe takes drastic measures, which immediately forces EURUSD to grow.

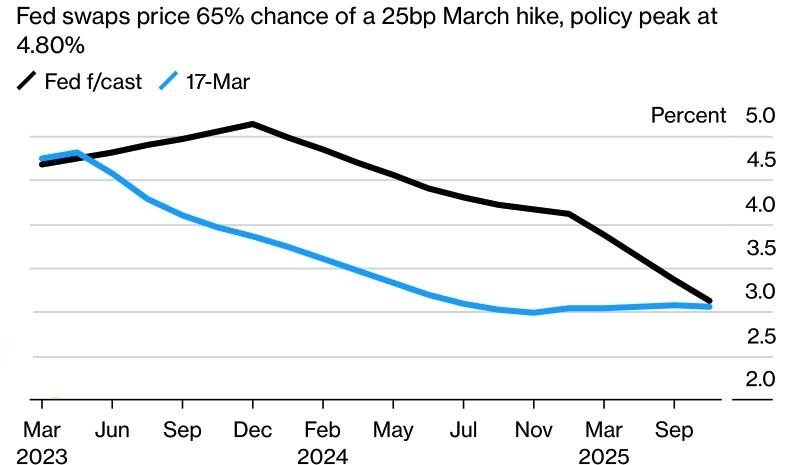

The OECD calls a 50 bps ECB deposit rate increase in March the right decision. Since the average hourly wage in the Eurozone is growing by 5.7% and overtaking the US counterpart, the rate increase is logical. The decisive actions of the ECB have again made the topic of raising the federal funds rate by 25 bps (at the meeting on March 21-22) relevant. However, earlier derivatives signaled the end of the Fed’s monetary tightening cycle.

The market’s belief in the Fed’s dovish reversal in 2023 and that the start of a recession is much closer than expected contrasts the opinion of economists and global investors. 49% of Financial Times experts predict that the federal funds rate will reach 5.5% (which is significantly higher than 18% in the December survey). 16% of respondents believe that the borrowing cost will rise to 6% or higher.

Most of the 519 global investors surveyed by MLIV Pulse believe that the US economy will be able to avoid a recession despite the banking crisis. Two-thirds of respondents expect it to either make a soft landing, or take off, or maintain its current fast speed. The Fed will have to raise the borrowing cost several more times to bring inflation closer to the target.

Weekly EURUSD trading plan

Despite the scale of the banking crisis, most experts and investors remain calm, believing that it will end soon. Markets will once again focus on monetary policy. The intention of the ECB to raise the deposit rate faster than the Fed will strengthen the EURUSD. The desire of the head of the Bank of Austria, Robert Holzmann, to bring the deposit rate to 4% will contribute to this. If so, continue to buy the pair in the direction of 1.0755 and 1.0825.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.