No matter how much effort the Fed makes to cool the US economy, the situation remains the same. The chances of a US recession are growing, and the central bank needs to take some action to achieve its goals. Let’s discuss this topic and make up a trading plan for EURUSD.

Weekly US dollar fundamental forecast

To determine where to invest money and the future EURUSD rate, traders must understand what is happening with the US economy. But it is impossible to do now. A series of positive US macrostatistics refuted the idea that the country is preparing for a recession due to the Fed’s aggressive monetary restriction. If the situation remains the same, the question will arise whether all central banks should be closed. The biggest reversal in their monetary policy in decades does not affect the economy.

Why is the economy growing again instead of the expected soft or hard landing? Is the good weather to blame, or were expectations too low? Is the economy unstable due to the recovery from the pandemic or the increased federal funds rate?

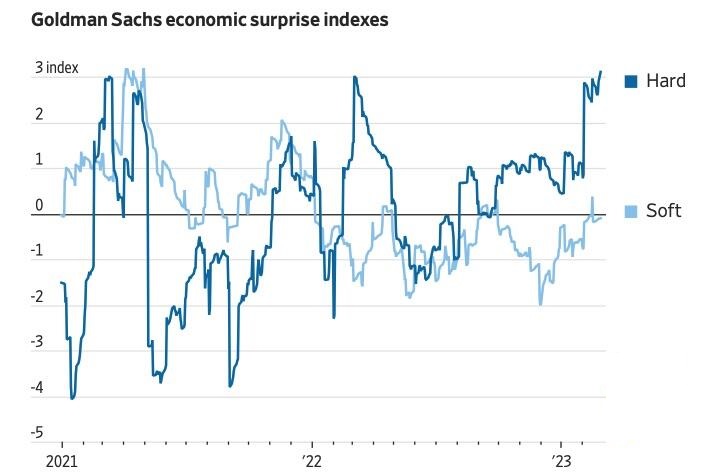

The situation is exacerbated by the contradictions between solid data, such as unemployment and retail sales, and soft data, based on surveys. Solid data economic surprises were the biggest since the Fed began to tighten monetary policy. The situation concerning soft data is different.

When the market does not understand what to do, it behaves inadequately. For a long time, US stock indices perceived good news from the economy as bad news for themselves. However, stronger-than-expected ISM manufacturing data helped the S&P 500 close in the green after four weeks in the red. Investors are beginning to realize that high rates will not destroy the economy. Why do we need a central bank if no matter how much the Fed cools the economy, it will continue to be hot?

There is an opinion that the consequences of monetary restriction will begin to have an impact only at a certain rate level. Either the Fed has not reached it yet, or the time lag is too short for the economy to start to cool down. In any case, the Fed cannot risk raising borrowing costs in response to strong data. In this case, Jerome Powell has to turn hawkish during his two-day speech before the US Congress.

However, the situation will be clarified not by the Fed chairman but by the US February jobs report. Bloomberg experts predict an increase in employment by 215 thousand, but the previous estimate was exceeded by almost three times, which casts doubt on the new one.

Weekly EURUSD trading plan

Jerome Powell’s speeches in Congress and the release of employment data, which investors have been looking forward to seeing for several weeks in a row, predict increased volatility of EURUSD. There is a high probability of false breakouts of the consolidation range 1.0575 – 1.0675. In such conditions, stay out of the market, or change positions frequently, fixing insignificant profits.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.