To buy dollars one needs opportunities. And there will be more opportunities if the Fed raises the rate by half a point in May and June, rather than at the FOMC March meeting. Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly US dollar fundamental forecast

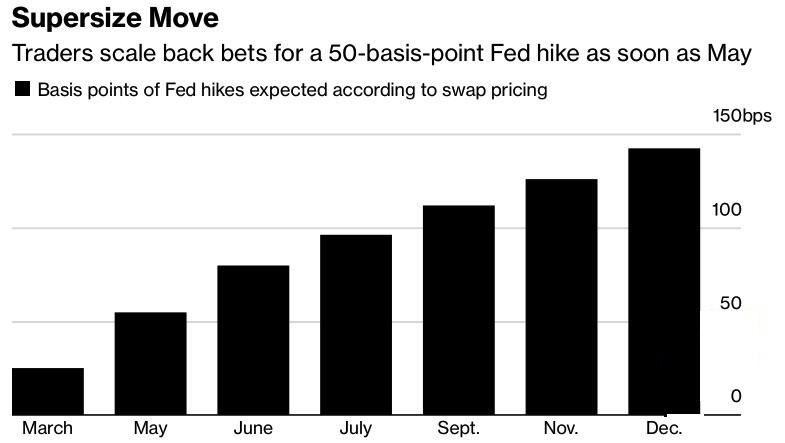

Markets rise on expectations and fall on facts. In this regard, the Fed’s unwillingness to start an aggressive monetary restriction in March, with a growing likelihood of a half-a-point hike in the federal funds rate in May or June, is a bullish driver for the US dollar. There is a reason to buy on expectations, while a strong start of the cycle could be the basis for selling greenbacks on facts. After Jerome Powell’s speeches before Congress, the CME derivatives have cut the chances of rising borrowing costs from 0.25% to 0.75% at the FOMC March meeting from 40% to 20%. However, they signal speeding up of monetary tightening in the future, which has been the reason for the EURUSD drop to the lowest level since May 2020.

During his second speech before Congress, Jerome Powell mentioned two advantages of the US dollar. He said that the events in Ukraine could press down the risk appetite and lead to a reduction in investments. Everyone knows that one of the key bearish drivers for the EURUSD is the high demand for safe-haven assets, primarily for greenbacks in the face of uncertainty, increased volatility and reduced risk appetite.

The Fed Chair noted that due to the war in Ukraine and Russia’s influence on commodity markets, inflation will remain at high levels for longer than expected. The day before, Jerome Powell argued that if this happened, the central bank would raise rates more aggressively. Between suppressing inflation and the need to avoid a recession, the Fed will choose inflation, which suggests that borrowing costs at the end of 2022 may be even higher than the big banks and financial markets are currently predicting. The Cleveland Fed, based on simple monetary policy rules, has stated that the federal funds rate should currently be at 3.23% and rise to 3.72% and 3.95% by the end of 2022 and 2023.

The Fed prioritizes inflation and is not worried about a recession, as evidenced by John Williams’ speech. The New York Fed President noted that there couldn’t be any stagflation, as the US economy is approaching the start of the monetary restriction cycle with a strong momentum. Naturally, the US economic recovery is robust given its territorial remoteness from the conflict zone, unlike the euro area. In Europe, the problem of stagflation may become very acute in the near future.

Along with the divergence in monetary policy and growth gap, as well as the high demand for safe-haven assets, the EURUSD bears are supported by a strong demand for dollar liquidity. Key indicators signal an increase in the US dollar funding costs due to the war in Ukraine.

Weekly EURUSD trading plan

Due to the conflict in Eastern Europe and Jerome Powell’s hawkish speeches, the EURUSD reached the suggested target at 1.105. It is still relevant to sell the euro towards the second target at $1.092, which may not be the final downside aim.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.