Despite more hawkish comments from Fed officials and a drop in US stock indexes, which should have strengthened the US dollar as a safe haven, the EURUSD isn’t falling. Why? Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

Forex is an unsolvable mystery. Once investors solve a puzzle, there immediately appears another one. A few days ago, markets anticipated the reaction of central banks to elevated inflation levels; now, they are concerned with another question. If the omicron is more dangerous than all previous strains of COVID-19, how will the Fed and other central banks respond to government restrictions? Will they be able to add monetary stimulus in the face of excessively high prices?

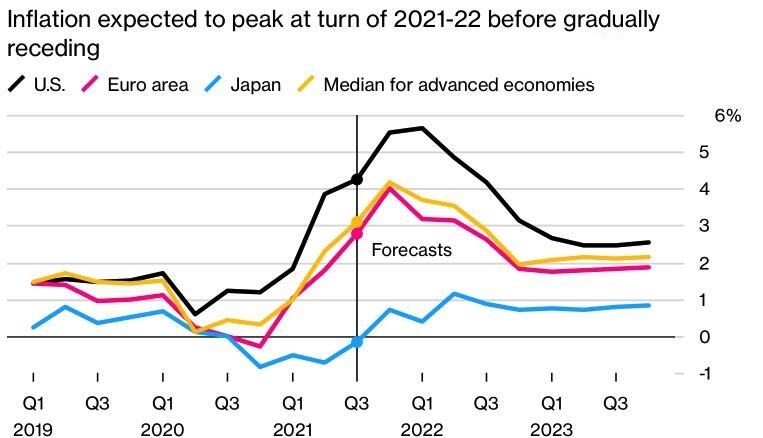

According to the OECD, the current situation poses a major challenge for central banks, which should be prepared to intervene but not overreact in curbing inflation. The OECD has raised its CPI forecast for 2022 for the US from 3.1% to 4.4%, for the euro area — from 1.9% to 2.7%. It is expected that in 2023 consumer price growth in the USA will be 2.5%, in the currency block — 1.8%. Inflation in advanced economies will peak in the first half of next year and then begin to slow down. However, inflation will remain elevated longer than previously thought.

The OECD believes the omicron increases an already high level of uncertainty and could pose a major obstacle to the global economic recovery. If not worse. Financial markets fully agree with the authoritative organization, and the volatility is growing, supporting safe-havens, such as the euro and the yen, even amid a drop in the US stock indexes.

The EURUSD bulls go ahead not only because bears are exiting carry trades. A sharp spike in the euro-area inflation increases political pressure on the ECB. German Finance Minister Olaf Scholz says Berlin will have to take active steps if the situation with prices doesn’t improve as previously thought. The risks of the ECB monetary normalization haven’t been priced in the euro exchange rate. Therefore, if Christine Lagarde changes her tone abruptly, the major currency pair can well be rising.

Conversely, the US dollar price includes a significant part of the positive associated with the Fed’s plans to taper the QE and at least two federal funds rate hikes in 2022. Federal Reserve Bank of Cleveland President Loretta Mester says that making the taper faster is buying insurance and optionality in case inflation doesn’t move back down. Jerome Powell shares the same viewpoint. In his speech to Congress, he has noted that monetary policy has adapted to persistent inflation and will continue to adapt. It is a clear hint at accelerating normalization.

Weekly EURUSD trading plan

Thus, with increased uncertainty due to the omicron and political pressure on the ECB, the euro is not falling dramatically even amid Fed’s hawkish comments. Currently, it is relevant to buy the EURUSD on the breakout of the resistance at 1.1365 or sell if the price breaks out the support at 1.129.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.