Due to Fed’s aggressive monetary tightening, high safe-haven demand, and American exclusivity, the EURUSD bears control the market. Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

Remember the past, but don’t forget the present. Trying to predict exchange rates, traders often turn to history. The current situation is compared to the 1970s, when consumer prices were also high, and the Fed aggressively tightened monetary policy to curb inflation. But here’s the paradox. From 1974 to 1980, the US dollar weakened against the German mark, its main competitor in those years, by 40%. Now, it is strengthening against the euro, and more and more analysts are talking about parity. It seems that inflation used to press the greenback down, but now, on the contrary, it supports the dollar rally. How could it be so?

Of course, the world is changing. Old decorations become obsolete and give way to new ones. In the 1970s, the US was a net importer of energy, and the oil embargo hit its economy just like it does to Japan and its yen today. However, the US is now a net exporter of the black stuff, and it can afford to ban its oil imports from Russia and push the EU to join the embargo.

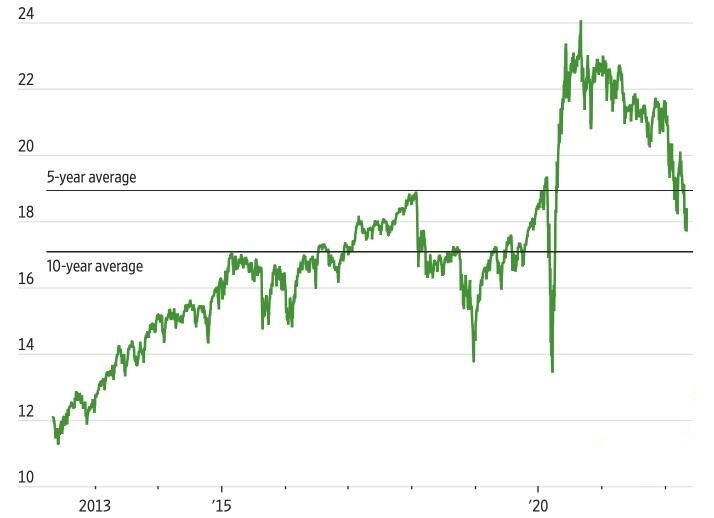

Now, in the face of high geopolitical risks and the Fed’s aggressive monetary restriction, the US dollar is the most popular safe haven. Despite a recent drawdown in the forward P/E ratio, the US stocks still look overvalued, and the S&P 500 could well continue falling. This circumstance also sets the EURUSD bulls back.

The USD index rose to 20-year highs not only due to the Fed’s intention to quickly bring the federal funds rate to a neutral level and the high demand for the greenback as a safe haven. The US economy simply looks better than the rest. Thanks to massive fiscal stimulus and speedy vaccinations, it has been less affected by COVID. It is not particularly affected by the dependence on Russian oil and gas and the war in Ukraine. As a result, US strong domestic data press the EURUSD down.

For example, US employment increased by 428,000 in April, and the EURUSD has been up to 1.05. Despite the labour shortage, the US employment has been up by 400,000 or more for the 12th consecutive month, which makes the Fed act swiftly. In such a labour market, wages will continue to rise, fueling inflation and forcing aggressive rate hikes.

These factors underlie the MLIV Pulse forecast, according to which 60% of more than 400 economists and portfolio managers believe that EURUSD will be down to parity. 48% expect the pair to hit 0.95. This is significantly lower than the major banks’ consensus estimate of the euro recovering to $1.12 by the end of the year. None of the banks expects to see parity.

Weekly EURUSD trading plan

Time will show. In the meanwhile, the EURUSD is going down. If the price breaks out the support at 1.049, one could add up to shorts entered earlier. The targets are at 1.041 and 1.031.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.