Successful auctions of US Treasuries were the result of high demand, which lowered yields and weakened the US dollar, supporting the EURUSD. Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

US Treasury yields are falling, giving the S&P 500 its eighth record close in 2024, as investors ignored the comments by FOMC officials about a lack of urgency to ease monetary policy. The markets have created a perfect storm for the US dollar, so it is not surprising that the EURUSD is going up.

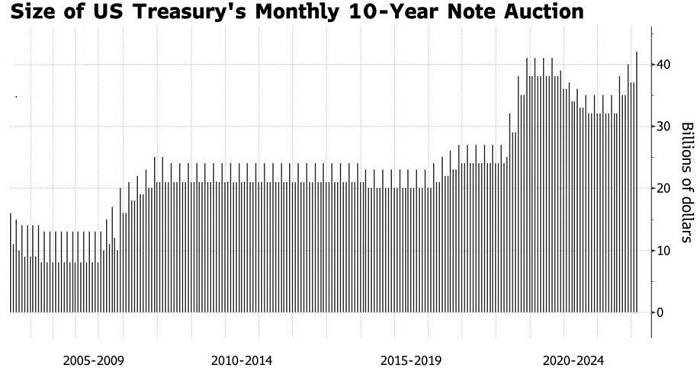

It is no secret that the main drivers of the USD index rally at the beginning of the year were the growing yield of Treasuries and the market’s revaluation of expectations for the federal funds rate. Both factors are associated with strong economic reports, but they are not the only ones influencing the bond market. Successful sales of $52 billion in three-year Treasuries and $42 billion in 10-year Treasuries were the result of increased demand, which lowered bond yields and weakened the US dollar.

The latter figure turned out to be a record. The previous peak in sales of 10-year Treasuries occurred in November 2020. The Treasury is scheduled to reach records in three of seven issues, including two- and five-year securities, in February-April.

Lower bond yields are creating a tailwind for the US stock indices and the EURUSD. However, it’s not just auctions that influence bond yields. The major drivers are the Fed’s monetary policy and the strength of the US economy. At the same time, the slowness of the Federal Reserve and US positive domestic data signal that the decrease in Treasury yields is temporary.

According to Minneapolis Fed President Neel Kashkari, the central bank would like to see several months of inflation data before starting to cut rates. The official sees 2-3 acts of monetary expansion in 2024. Richmond Fed president Thomas Barkin supports a policy of patience to get where the Fed needs to go. The president of the Boston Fed, Susan Collins, believes that, at the moment, monetary policy is in the right place, and its easing should be expected at the end of the year.

Adriana Kugler noted that a further slowdown in inflation will make it advisable to lower interest rates. However, if disinflationary processes stall, it would be appropriate to keep borrowing costs at the current level. Investors share the same point of view, expecting that the release of US CPI data for January will give a clue about the Fed’s further actions and change the balance of power in the derivatives market.

The euro is supported by Isabel Schnabel’s calls for patience and caution. Historical experience shows that inflation can flare up again. The ECB official believes the last mile of the fight against high prices will be the most difficult.

Weekly EURUSD trading plan

The perfect storm for the US dollar supports the EURUSD correction. However, the euro bulls will hardly go ahead before the US inflation report is published. Therefore, I recommend selling the euro with the targets at $1,073 and $1,064.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.