The Fed is considered a leader of the world’s central banks. Recently, the leader has shown signs of weakness, signalling a pause in monetary tightening. How does this affect the EURUSD? Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

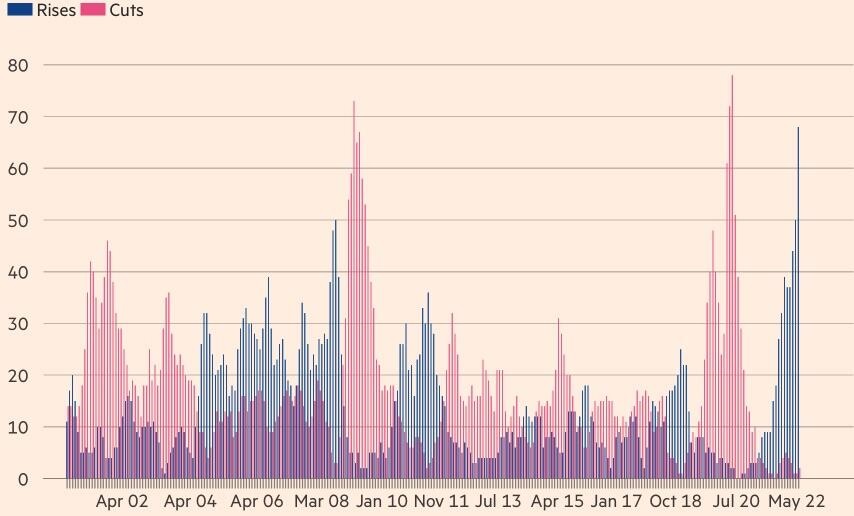

Central banks usually follow the Fed, but the US central bank seems to be losing its leadership. In spring, central banks around the world carried out 60 interest rate hikes, the most widespread monetary tightening since at least the beginning of 2000. Capital Economics believes that central banks have embarked on the most coordinated monetary restriction in decades. If this happens, the US dollar usually weakens. The US currency could be strengthening if the global were to rapidly recover, but this is not the case now.

Economists at Barclays call the tightening cycle a truly global phenomenon. The widespread trend made it more likely policymakers would consider more substantial moves. Announcing unexpectedly larger or earlier policy steps feels easier if everyone else is doing them. The European Central Bank looks set to raise borrowing costs for the first time since 2011 in July and end its eight-year experiment with negative rates in September. So, the euro rally is supported amid the weakening dollar.

The US personal consumption expenditures price index slowed down to 6.3% from 6.6%, and the core PCE declined to 4.9% in April from 5.2% in March, a still-elevated level that nonetheless indicated that price pressures could be easing. Investors see the signs of a potential pause in the Fed’s monetary tightening. Furthermore, the US nonfarm payrolls are expected to slow down to 325,000 in May, while average wage growth is to decline to 5.2% from 5.5% in April. Investors expect that, following two rate hikes of 50 basis points in June and July, the Fed should take a break to estimate the economic situation. Bloomberg warns that if there should be any pause, it won’t occur till the end of 2022.

Will the US central bank take a pause if the financial conditions aren’t tightened? All three major US stock indexes have increased by at least 6% in the week ended May 28, featuring the best growth since November 2020, while the Treasury yields and greenback are down.

On the other hand, the governor of the Dutch central bank Klaas Knot said a further acceleration in inflation would increase the chance of a 50-basis-point rate hike in July. Therefore, the report on the euro-area PCI for May is an important event. All but one Bloomberg expert forecast an acceleration in CPI from 7.4% to 7.8%. At the same time, inflation in Germany runs the risk of accelerating to 8.1%, and in Spain, it could speed up to 8.3%. In my opinion, the euro is currently rising on expectations of the important report publication. Differently put, the euro is rising on the news. So, it could be sold off on the facts.

Weekly EURUSD trading plan

I don’t think the US weak jobs report will influence the Fed’s monetary policy. The US central bank won’t abandon the plan to raise the rates by 50 basis points in June just because of a single report. Therefore, it might be relevant to exit the EURUSD longs entered at 1.06 because of the reports on the euro-area inflation and US employment.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.