The US dollar and the S&P 500 are rising due to the US exclusivity. The same factor prevents the Fed from cutting the rates soon. Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly US dollar fundamental forecast

A strong economy means a strong currency. At the same time, a strong economy is a reason to buy stocks. One of the main paradoxes of January was the simultaneous rally of the S&P 500 and the US dollar. Greenback outperformed all of its G10 competitors, with the exception of the pound. At the same time, the strong US economy, according to Goldman Sachs, allows the broad stock index to withstand rising Treasury yields.

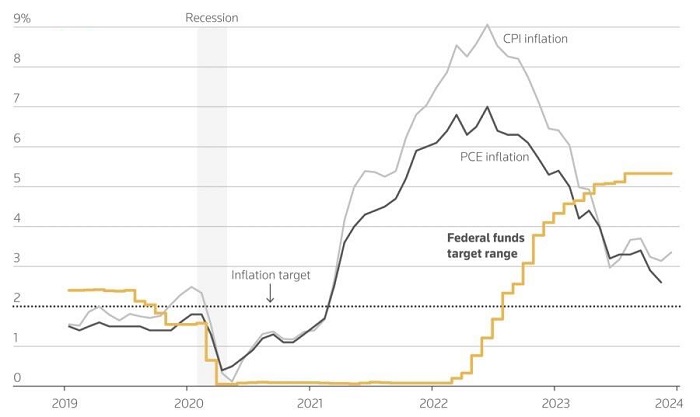

The US exclusivity supports the US dollar and lets the Fed wait and see. The central bank has no need to stimulate a strong economy. Its strength can trigger a new round of inflation. With premature monetary expansion, the Federal Reserve risks making the same error as its predecessors did in the 1970s. They believed ahead of time in victory over high prices and were forced to pay for it with a double-dip recession.

However, there is an alternative opinion among investors. Trust Investment Advisors believes the Fed is making a mistake. Unless the central bank begins to ease monetary policy, the delayed effects of the most aggressive monetary tightening in decades will trigger a severe recession. Real rates are too high, and they get even higher as inflation falls. Sooner or later, the frame of the building will crack, which will force the Federal Reserve to cut rates not by a quarter point but by half a point and more. This will spook the markets and cause turmoil. So isn’t it better to take the first step in March?

If the Fed meets investors’ expectations, financial conditions will weaken even further. The $6 trillion in liquidity from money market funds, according to Navellier & Associates, will flood into stocks as soon as the fed funds rate begins to decline. Many people need confirmation that the Federal Reserve has started a cycle of easing monetary policy. As a result, the S&P 500 will continue breaking through the all-time highs, Treasury yields will fall, and the US dollar will weaken. What’s more, financial conditions will stimulate the already hot economy.

So, the Fed’s best solution is to wait and see. The regulator should observe new data to make the right decision. This is what the central bank intends to do in January. Investors expect Jerome Powell to criticize the market pricing of 5-6 acts of monetary expansion in 2024. However, will the Fed chairman bother himself with such a trifle? If not, the US dollar risks weakening against a basket of currencies.

Weekly EURUSD trading plan

The euro, with its concerns about a slowdown in euro-area GDP in the fourth quarter, is no exception. Everyone around knows that the economy of the currency bloc is on the verge of a downturn. This factor has been priced in the EURUSD, which might encourage investors to buy the euro on facts following selling on the news. The bulls won the first battle for support at $1.08. If the price breaks out the resistance of $1.085, it might be relevant to buy the pair.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.