The forecasts of Reuters experts generally match the FOMC projections, the federal funds rate should rise to 3.5% before the end of 2022. This factor has already been priced in the EURUSD quotes. The pair needs a fresh driver. Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly US dollar fundamental forecast

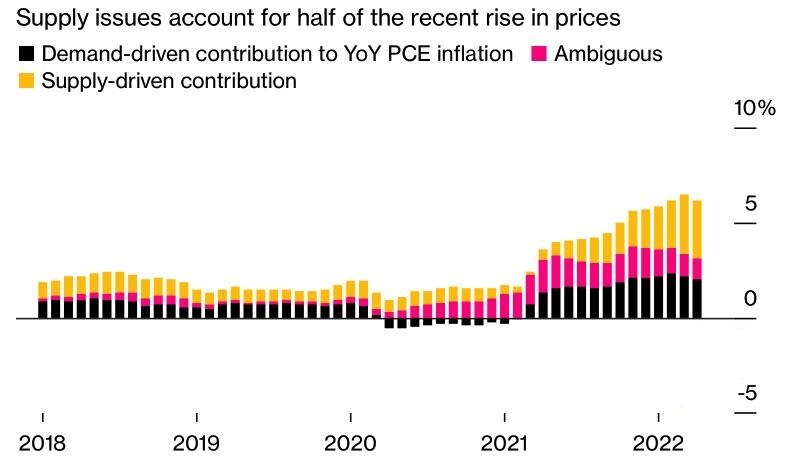

According to research published by the San Francisco Federal Reserve, supply issues account for around half of the run-up in current inflation levels, while only about one-third of the current bout of high inflation in the United States is demand-driven. Since supply shocks dampen economic activity, their prevalence in price growth increases the risk of entering stagflation. The Fed can only influence demand, its capabilities of regaining control over inflation are limited. However, the central bank has a plan, and this circumstance encourages the EURUSD bears.

At a press conference following the FOMC June meeting, Jerome Powell stressed that many factors that the Fed does not control would determine the future course of interest rates. Rising food and energy prices affect inflationary expectations, which the central bank cannot allow to accelerate further. Until there is convincing evidence that inflation is under control, the Fed will continue to aggressively tighten monetary policy.

Investors are looking to Jerome Powell’s speech before Congress for clues as to how much the rate will rise in July, by 50 basis points or 75 basis points. Reuters experts seem to have already decided. 67 out of 91 specialists rely on the second option, which will bring the indicator to a neutral level of 2.5%, which, as previously considered, does not stimulate or restrain economic growth.

The vast majority of economists forecast an increase in borrowing costs by 50 basis points in September, and opinions are divided between 25 or 50 basis points in October. Most respondents vote for a 25-basis-point rate hike in December. The consensus estimate suggests it will rise to 3.5% by the end of 2022, which is in line with the June FOMC forecast of 3.4%.

Thus, the speed of the Fed’s monetary tightening has been determined in general and, most importantly, has already been priced in the EURUSD quotes. This fact holds back the euro bears. So, until there are fresh drivers, the EURUSD is naturally consolidating.

Furthermore, traders are exiting the euro shorts ahead of the euro-area PMI publication, Jerome Powell’s speech before the Congress, and the release of the final value of inflation expectations in the US by the University of Michigan. The same happens in the US stock market. Following the biggest sell-offs since March 2020 in the week ended June 17, the stock indexes are being corrected up. Traders stay away from the market wondering if the Fed will slow down its monetary tightening amid the drop in the US stock indexes, the rise in the Treasury yields, and the associated tightening of financial conditions.

Weekly EURUSD trading plan

The EURUSD is consolidating in the range of 1.046-1.056, and the bulls failed to break out the upper border of the range. The bears might be more successful in testing level 1.046. I recommend selling.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.