The US economy looks strong, and the EURUSD is falling due to the US exclusivity. Will the greenback continue strengthening, or will the US GDP slow down, supporting the major currency pair? Let us discuss the Forex outlook and make up atrading plan.

Weekly US dollar fundamental forecast

It’s hard to believe that the Fed will cut rates not 6 times but 3-4 times in 2024, and the US economy, instead of a soft landing, will take off again. Changing market expectations resulted in a strengthening of the US dollar in January-February, but the EURUSD is recovering at the end of winter.

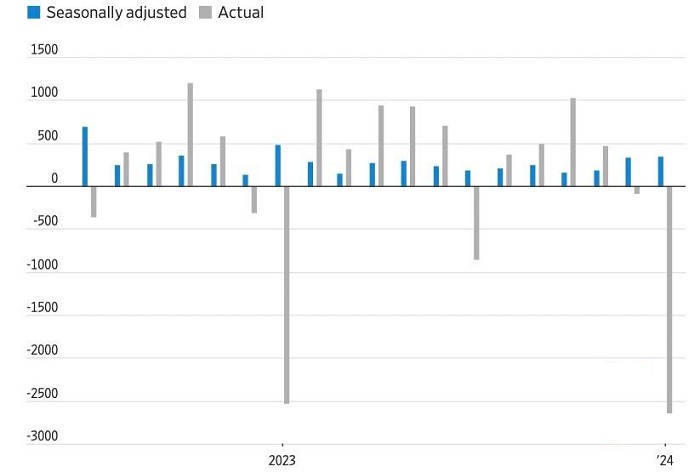

As soon as signs of a slowdown in the US economy appear, greenback bears go ahead. Moreover, they are ready to look for signs of weakness even in strong economic data. The impressive employment growth of 353,000 in January was not without criticism of the calculation of the indicator. They say the report reflects seasonally adjusted figures. They are too high and might be revised down in the coming months.

A lot depends on whether the US economy will face a soft landing or take off again. In the first case, the US dollar will lose such a driver as the US exclusivity. However, for now, the economy looks strong. The reasons must be sought not only in fiscal incentives and excess savings of the population but also in migration and war.

While Congress is concerned about the influx of illegal immigrants, the Budget Office is raising its GDP forecasts. With the labor force growing 1.7 million above potential in 2024 and 5.2 million in 2033, the economy will be 2.1% larger. Budget tax revenues will increase, and its deficit will be 6.4% of GDP after a decade, and not 7.3%, as expected in 2023.

According to White House calculations, of the $60.7 billion in aid to Ukraine, 64% of this amount will return to the US defense industry. Industrial production in this industry has increased by 17.5% since February 2022 due to the Pentagon increasing orders for Kyiv and the EU and replenishing its own reserves.

The US GDP is expanding due to the military industry. The greenback could retain such a driver as US exceptionalism, allowing the Fed to hold interest rates at the current levels for a long time and investors to save money in money market funds. The increased demand for bonds could press down the yields, and the demand for stocks should support the global risk appetite, which is good news for EURUSD.

Thus, the EURUSD medium-term prospects are unclear. In the short term, investors fear that the Fed will confront the market on the timing of its first rate cut, which will be reflected in the FOMC minutes. Its potential hawkishness holds back EURUSD bulls. In fact, the situation is similar to that of December, when Jerome Powell’s failure to reassure the markets resulted in a USD drop.

Weekly EURUSD trading plan

I would suggest buying the pair if the EURUSD doesn’t drop below 1.073 or goes above 1.079.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.