The greenback is trading flat and seems to feature no reaction to the market turmoil, but this is an illusion. The EURUSD traders are stressed and about to rush ahead. The pair could exit the trading range of 1.127-1.135.

Fundamental US dollar forecast today

When people look calm, it doesn’t always mean they have no feelings. While the EURUSD swings around level 1.13, amazing things are happening in the market. US stock indexes drop by 4%-5%, and then quickly recover and close the day in the green zone. Never before has the Dow Jones covered the losses during one trading session if it fell by 1000 points or more. On Jan. 24, the drawdown was 1100 points.

Such a move was the biggest of its kind since January 2001, in the middle of the come-down from the dot-com bubble. Most of the other similar moves occurred in the next three years, with a few others coming during the 2008 financial crisis. Investors are trying to take into account many factors, including the Fed’s intention to hike the rates aggressively, the risks of a Russian invasion of Ukraine, and the omicron. Some traders are willing to buy out the drawdowns, although earlier since the beginning of the year, the crowd was actively selling on the price rise.

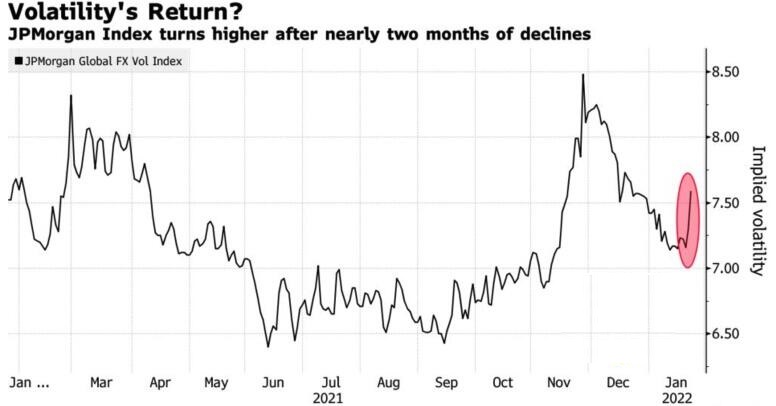

Bears, like Mizuho, expect the S&P 500 to drop by 12% as the panic grows. Bulls, like Credit Suisse, believe that a 27% rise in corporate profits and low real bond yields will support the US stock indexes. This is about volatility rather than a correction. High volatility is featured by the Forex as well, which increases the demand for safe-havens, like the euro and the yen, and encourages investors to sell off risky currencies, like the Australian and New Zealand dollars.

Investors are concerned about the Fed’s willingness to act aggressively, although the US economy almost stopped at the beginning of the year because of the omicron. Markit US Composite PMI has been down to 50.8, an eighteen-month low. Nonetheless, most of the negative is due to the lack of staff, and not to lockdowns, as before, according to Capital Economics. Domestic demand remains high. This gives reason to hope for a quick recovery of GDP as the epidemiological situation improves.

Market analysts suggest the Fed should stop the QE immediately, send clear signals about three or four rate hikes in 2022, and announce the plans to unwind the balance sheet already in March. Last time, after quitting asset purchases in 2014, the Fed held the balance sheet at the same level for 2.5 years and reduced it from $4.5 trillion to $3.7 trillion from 2017 to 2019. The current situation is different. The US central bank needs to move faster, or it risks losing credibility by chasing growing inflation rather than outpacing it.

The expectations of a hawkish surprise from the Fed encourage speculators to buy the US dollar, which they were selling in the week ended Jan. 18 at the fastest pace since June 2020.

EURUSD trading plan today

In my opinion, if the Fed does not report anything new following the meeting on January 25-26, EURUSD could rise. Hints at a 50-basis-point rate hike in March, the QE completion, or other hawkish surprises will encourage the bears. In the meanwhile, the major currency pair is consolidating in the range of 1.127-1.135 ahead of the outcomes of the FOMC meeting. I don’t recommend entering any trades.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.