Jerome Powell’s hawkish tone at the press conference following the FOMC January meeting should have discouraged the EURUSD bulls. However, the euro buyers do not give in. What’s the reason? Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

How complex are factors driving financial markets! It would seem that the federal funds rate hike to 1.5% by the end of 2022, provided that the ECB deposit rate continues to be below zero, should encourage the EURUSD bears to go ahead. However, the major currency pair has rebounded up from its 19-month low. Five Fed’s rate hikes have been already priced in the US dollar quotes while the ECB is growing more likely to start normalizing its monetary policy.

The EURUSD worst weekly drop over the past seven months in the week ended January 28 resulted from the expectations that the Fed would act more aggressively than previously suggested. However, none of the six FOMC members speaking after the Committee’s meeting supported the idea of raising the rate by 50 basis points in March. Even such a hawk as James Bullard said, “I don’t think a 50-basis point hike really helps us right now.” St. Louis Federal Reserve President said he favours lifting rates at the Fed meeting in March and likely again in May. He expects five rate hikes in 2022, just like the derivatives market. The Fed’s centrists and doves seem less aggressive, so the CME derivatives forecasts are likely to be overestimated.

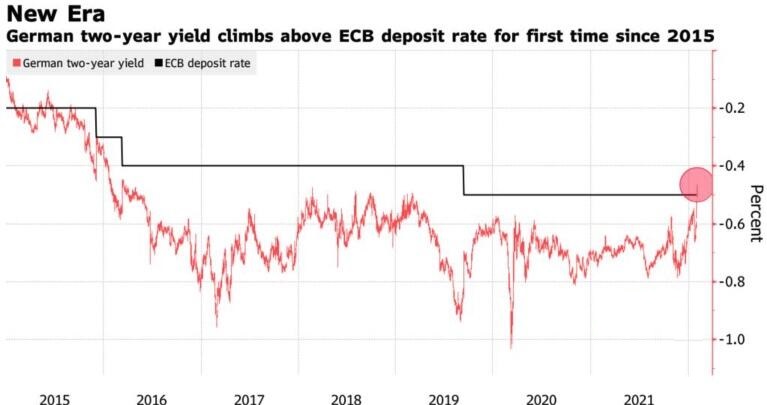

In Europe, by contrast, the chances of normalizing the ECB’s monetary policy are increasing. Before Jerome Powell’s speech, the derivatives market predicted one ECB rate hike by ten basis points, but after it, there are expected two increases in the borrowing costs, with the first one occurring in July. Germany’s two-year bond yields climbed above the European Central Bank’s deposit rate for the first time since 2015. According to ING, the ECB could bring the deposit rate back to zero in 2023, and German bonds should be trading with a positive yield by the middle of next year.

The EURUSD bulls are also supported by the best three-day rally in US stock indexes since November 2020. The stock market is rising after the sell-off. The bears are betting on the Fed’s aggressive monetary restriction, and the bulls are encouraged by the US strong economy, the labour market, and corporate reporting. According to FactSet, 77% of S&P 500 companies have outperformed earnings expectations. The P/E ratio for the index has returned to its February 2020 values. So, the US stock market must have recovered from the pandemic fallout.

The stabilization of Treasury yields also supports the rally in the S&P 500 and the euro. Treasury buyers are surprised with Powell’s hawkish stance and suppose that US inflation will slow down on its own, making the Fed tighten its monetary policy less aggressively in the second half of the year.

Weekly EURUSD trading plan today

The US jobs report for January could clarify the situation. Concerns about weak employment press down the greenback. If nonfarm payrolls do not go negative, the euro bears could hold the price below $1.132 and try to restore the downtrend. Otherwise, the bulls could try to turn the trend up. In the meanwhile, I suggest the strategy of selling the EURUSD on the price rebound down from resistances at 1.1275 and 1.132.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.