When US stock indices break through all-time highs, Treasury yields rise, and the chances of Fed monetary expansion increase, EURUSD usually rises. But not this time. Why is the dollar rising? Let’s talk about this topic and draw up atrading plan.

Weekly US dollar fundamental forecast

Every asset has support. US dollar – American exceptionalism, S&P 500 – belief in the Goldilocks economy, Treasuries – slowing inflationary pressure. The only instrument that lost was the euro after Christine Lagarde did not want to criticize the markets for their expectations of a deposit rate cut. EURUSD has been down to its lowest levels since mid-December, and only the unfavorable background for the greenback as a safe haven asset prevented the USD bulls from doing more.

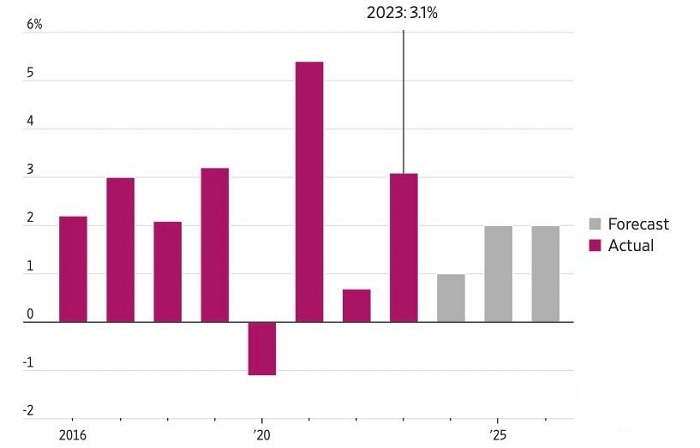

In the fourth quarter, US GDP expanded by 3.3% Q-o-Q, significantly exceeding the Bloomberg experts’ forecast of 2%. Compared to the same period last year, the economy grew by 3.1%, which is significantly higher than the 0.7% expansion at the end of 2022. The US economy did not fall into recession, as experts expected. At the start of 2023, they predicted that gross domestic product would expand by a modest 0.2% in the October-December period. In fact, it turned out to be more than 3%.

The US economy is expected to avoid a recession, although growth will slow down significantly in 2024. However, when the labor market is still hot, lower inflation increases the purchasing power of the population. As a result, instead of a soft landing, the US economy may surge. At the same time, there is a risk that consumer prices will accelerate, which will force the Fed to abandon the reduction in the federal funds rate and ensure the US dollar’s victory in Forex by the end of 2024.

The greenback has jumped over the barrier of data showing a decline in PCE growth in the fourth quarter from 2.6% to 1.7%, which allowed the S&P 500 to break through its all-time high for the fifth time in a row, lowered Treasury yields, and increased the chances of the Fed starting monetary expansion in March from 41% to 51%. All this creates a headwind for the EURUSD bears, but instead of retreating, they go ahead.

Indirectly, Christine Lagarde might be responsible for the euro drop. She did not want to dissuade investors in their expectations for the ECB rate cut. She talked a lot about disinflation, including signs of slowing wages and falling energy prices. As a result, derivatives increased the expected scale of monetary expansion in 2024 from 130 basis points to 140 basis points and raised the chances of monetary easing in April from 60% to 80%. The EURUSD responded with a drop.

Thus, the market is focusing more on disinflation than on strong economic growth in the US. However, the earlier expected start of the ECB’s monetary expansion puts pressure on the euro.

Weekly EURUSD trading plan

EURUSD may improve its position due to the report on the personal consumption expenditure index for December. Core PCE is expected to slow to 3% from 3.2%, with its 6-month reading falling to 1.7%. Such a trend can push the Fed to an early rate cut, which, in theory, creates grounds for the euro to rebound from the lower limit of the consolidation range of $1.085- $1.1. However, if the bulls don’t go ahead, the pair should continue falling to 1.08.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.