The US exclusivity has been supporting the EURUSD bears for a long time. In January and February, this driver led the pair down. However, as soon as the US economy showed weakness, everything changed. Let us discuss the Forex outlook and make up atrading plan.

Fundamental US dollar forecast today

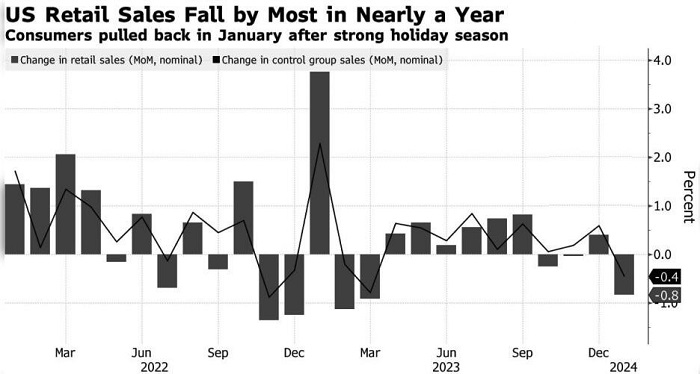

Investors hear what they want to hear. They ignored the decline in jobless claims and the acceleration in import prices to 0.8%M-o-M. Investors’ attention has been focused on the first contraction in industrial production in three months and a strong decline in retail sales. They indicate a cooling of the US economy and, in theory, could force the Fed to cut the federal funds rate earlier than expected. The EURUSD bulls have been encouraged.

The US exclusivity could cease supporting the US dollar, as it did in January and February. With Japan’s economy contracting in the fourth quarter, which saw it lose third place in the list of the strongest economies to Germany, stagflation in the euro area, recession in the UK, and problems in China, the US economy was the best performer. However, a dramatic 0.8% month-on-month decline in US retail sales, their worst performance in nearly a year, has changed the balance of power.

The indicator reflects consumer activity, the main driver of GDP growth. Its drop prompted a leading indicator from the Atlanta Fed to cut its forecast for US economic growth in the first quarter from 3.4% to 2.9%. Goldman Sachs did the same, reducing its estimate from 2.9% to 2.5%.

If the euro-area GDP accelerates due to slowing inflation, a strong labor market, and rising real wages, the growth gap between the euro area and the USA will not be so wide. This will further encourage the EURUSD bulls.

Yes, the European Commission has lowered its forecasts for the currency bloc’s gross domestic product from 1.2% to 0.8% in 2024 and from 1.6% to 1.5% in 2025, but there is a chance that the final results will be better than expected. If so, the euro will continue to strengthen.

Thus, if the strengthening of the US dollar in January-February was due to a change in market views on the changes in the federal funds rate and US exceptionalism, then at the end of winter, these greenback bullish drivers should cease to work. Now, the opinion of derivatives about the start of the Fed’s monetary easing in June coincides with the position of the US central bank. However, before this, investors were counting on March. The derivatives market forecasts a decline in borrowing costs by 90 basis points, which is close to a 75-basis-point rate cut in the FOMC forecast.

Moreover, the position of the US dollar as a safe-haven asset amid an unprecedented rally in the US stock indices looks extremely vulnerable. Fear should replace the Greed in the market.

EURUSD trading plan today

In my opinion, only inflation can stop the euro rally. In this regard, stronger data on the producer price index than the +0.1 M-o-M expected by Bloomberg experts could turn the S&P 500 trend down and discourage the EURUSD bulls. In this scenario, it will be relevant to sell with targets at 1.073 and 1.064. Otherwise, the slowdown in January PPI would suggest buying the euro on a breakout of $1.079.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.