According to Jerome Powell, the ceiling on the federal funds rate is higher than expected. So, a pause is out of the question. How will this affect EURUSD? Let’s discuss the topic and make up a trading plan.

Monthly US dollar fundamental forecast

The Fed managed to hint at a slowdown in monetary restriction, while keeping tight financial conditions. After the initial S&P 500 rise and the fall in the yields of treasuries and the US dollar, the situation changed dramatically during Jerome Powell’s press conference. The Fed chairman advised investors to stop paying attention to speed and focus on the final rate. It will be higher than expected. This circumstance forced the EURUSD bulls to step back.

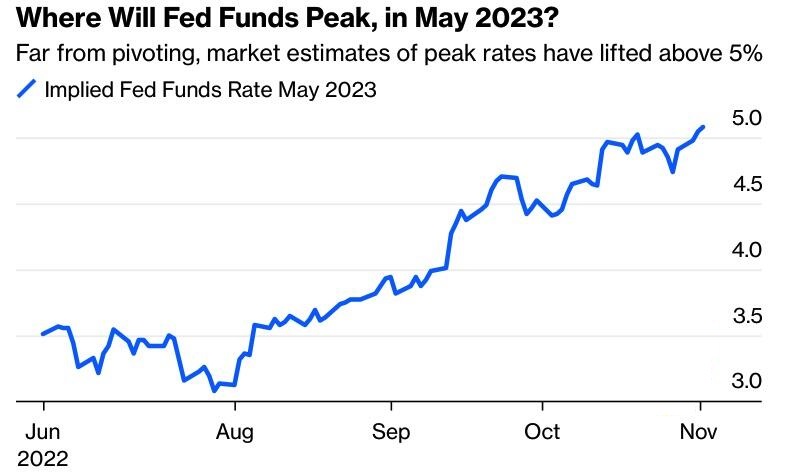

According to Jerome Powell, it is too early to discuss any pause in the monetary restriction. Although the decision to slow down the speed of rate hikes may be taken at one of the next two meetings, this is less important than the final rate. In accordance with the previous FOMC forecast, the interest rate was 4.6%. Now the derivatives market predicts it at a level of 5%. The Fed chairman seems to agree with this point of view.

Jerome Powell and his colleagues made the doves cry. Initially, the Fed’s intention to take into account the cumulative tightening of monetary policy and the lag with which it affects inflation and economic activity provoked an attack by EURUSD bulls. However, the Fed then punished the markets by dashing their hopes of a dovish reversal. For the third time in the past few months.

The Fed’s decision is the right one, both tactically and strategically. When rates are low, the central bank can raise them sharply. As borrowing costs rise, the impact of monetary tightening is harder to assess. In this case, it would be better to slow down. From a strategic point of view, the higher the rate ceiling, the greater its impact on inflation.

In the medium term, a further divergence in the Fed’s monetary policy with other central banks will increase the attractiveness of US assets and strengthen the dollar. Tighter financial conditions, which will worsen global risk appetite and increase demand for safe-haven assets, will also boost the USD index.

All the EURUSD bears need now is a strong labor market. This will allow the Fed to continue tightening its monetary policy. The higher the ceiling on the federal funds rate, the higher the chances of a recession. The probability of avoiding it has decreased, but it still exists.

Monthly EURUSD trading plan

The hawkish Fed confirms the stability of the EURUSD downtrend. Thus, enter sales on correction in the direction of 0.97 and 0.95.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.