Buy when everyone else is selling. This principle supported the EURUSD bulls following a strong US inflation report, but something went wrong. James Bullard’s turned everything upside down. Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

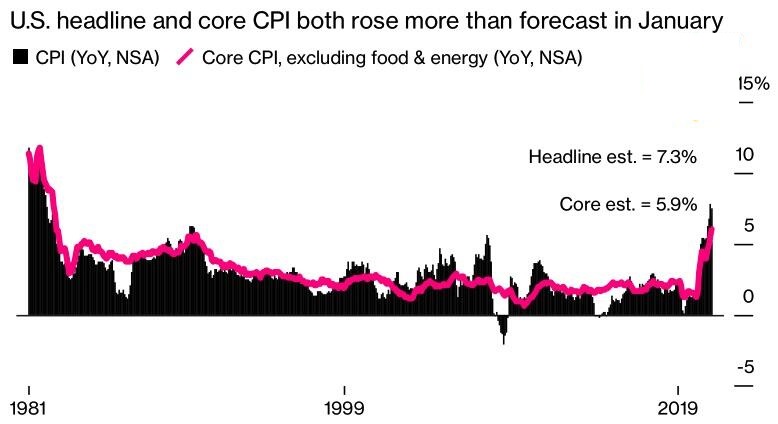

The storm should have followed the calm in financial markets that was before the publication of US inflation data. And the storm has exceeded the expectations! The surge in consumer prices to 7.5% and core inflation to 6%, both the highest levels since 1982, has pushed up 10-year US Treasury yields to the highest levels since August 2019. The US stock indexes and EURUSD was running up and down like a roller coaster. Following a drop below 1.13, the euro-dollar almost reached 1.15 and crashed down.

Before the inflation report, the S&P 500 closed seven of the previous nine trading sessions with gains, but the inflation acceleration to 40-year highs provoked another round of concern that the Fed will act too aggressively to curb uncontrolled price growth.

Dynamics of US inflation

Before Bullard’s speech, the EURUSD bulls were going ahead. A hawkish pivot in the ECB’s comments convinced traders that the EURUSD downtrend reversed up, and the good news for the greenback encouraged investors to enter euro longs. They were based on the principle ‘buy when all the rest sell.’ That was in the case with the US jobs report, that should have been with the US inflation data publication. Federal Reserve Bank of St. Louis President has spoiled the euro bulls’ party.

Bullard said he supports raising interest rates by a full percentage point by the start of July, calling for a half-point hike in March. He notes such a hot economy as now would have led to an extraordinary meeting of the Fed in the past, on which, of course, monetary policy would have been tightened. The US dollar buyers obviously liked the new bullish driver and sent the EURUSD price below 1.14.

Overnight index swaps give an 80% chance of the Fed’s rate hike by 50 basis points in March, signalling almost seven rate hikes in 2022. Goldman Sachs Group Inc’s economists are now calling for seven consecutive quarter-point hikes, up from the five they’d seen earlier. I suppose it looks too aggressive. The Fed will hardly make such a move in March, as it would be admitting the central bank had been wrong. The Fed remained passive for too long in 2021. Furthermore, Jerome Powell still believes the US inflation will slow down later in 2022.

Weekly EURUSD trading plan

After all, James Bullard is one of the most hawkish Fed members, and the US central bank’s policy is not a one-man show. Most FOMC members are not as aggressive. I suppose the market overreacts to the rate of the Fed’s aggressiveness. As the chance of a half-point rate hike in March weakens, the EURUSD bulls could go ahead. It will be relevant to buy if the price goes higher than 1.1425 or rebounds up from support at 1.135 and 1.131.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.