Investors are disappointed by the weak US nonfarm payrolls. However, the unemployment rate fell to 4.2%, suggesting the Fed could still quicken the wind-down of pandemic stimulus. How will this affect the EURUSD? Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

Headlines are important, but one should read the entire text to get to the bottom of the story. The announcement of the US department of labour rose by only 210,000 crashed the US stock market, Treasury yields, and the US dollar. Nonetheless, once investors realized that other jobs data are quite strong and the Fed will hardly abandon the plan to accelerate tapering the QE, the greenback has recovered its positions.

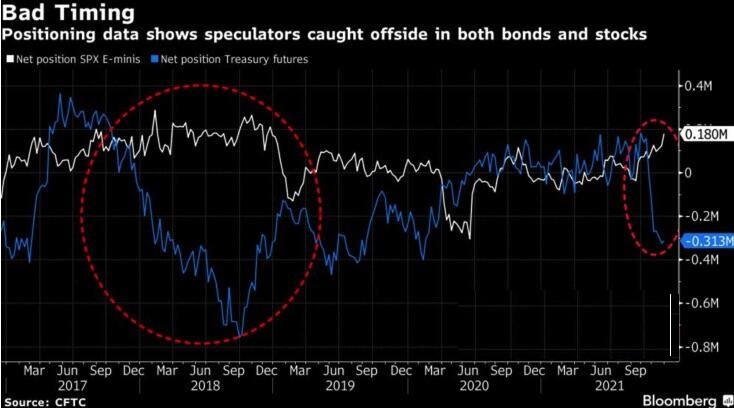

What is 210,000 if employment in 2021 increased on average by 555,000 per month? This is the worst performance since December 2020. Investors were naturally disappointed. Those investors, who were betting on the rise in the US stock indexes and Treasury yields, according to the Commodity Futures Trading Commission. Those investors, who increased US dollar longs against six major currencies to the highest level since June 2019. The headline has not been convincing, and the dollar was being sold off.

Dynamics of US employment and unemployment

Fortunately, investors don’t stop at headlines. They want full information. The rise in the labour force participation rate to 61.8%, the highest level since March 2020, and the average wages growth by a respectable 4.8%, as well as the drop in unemployment to 4.2%, reassured the EURUSD bears. Particular attention is drawn to the drop in unemployment because, according to the September FOMC forecasts, unemployment should amount to 4.5%-5%. St. Louis Fed President James Bullard, who believes that it will drop to 4% at the end of the first quarter, calls the US labour market very strong and insists on quicker tapering of the QE.

The Fed really needs to complete its quantitative easing programme as quickly as possible to start raising rates and curb inflation surge. It is especially acute in the context of consumer prices acceleration from 6.2% to 6.7% in November predicted by Bloomberg experts, the highest level since the 1980s.

It is clear that the risk of rising inflation currently outweighs the risks associated with employment. Еemporary factors such as supply chain disruptions, laboгr shortages, and fiscal stimulus may weaken. Still, the rejection of globalization, protectionism, the return of enterprises to the United States, and limiting the flow of migrants could result in a transition to a new inflation regime. If so, there would be no place for low interest rates. The Fed understands this very well, but the ECB still does not. According to Christine Lagarde, the inflation profile in the euro area is hump-shaped and eventually declines. The ECB will hardly raise the rates in 2022.

Weekly EURUSD trading plan

Divergence in monetary policies of the ECB and the Fed continues pressing down the EURUSD. If the price retests the support at 1.127, one could enter shorts. At the end of the week, the US inflation data will be published, and investors like buying the US dollar on the rumours.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.