The US consumer price index determines where US stock indexes will move, how the Fed will behave, and if the EURUSD will break outside the range of 1.01-1.03. Let’s discuss that and make a trading plan.

Fundamental forecast for dollar for today

It’s the key day! A US inflation report is ready to wake up financial markets and help the EURUSD, hovering in the range of 1.01-1.03, decide on a future direction. The same was said about US employment stats a few days ago, but even the impressive growth of 528 thousand did not wake the dollar up. The labor market is, however, just a tool, whereas inflation is the Fed’s target. Many assets depend on where and how fast inflation is moving.

The Fed is not glad that US average wages have been growing 5% monthly in 2022. The whole structure of business expenses expanded, including payrolls. As the latter grows, companies shift expenses on the consumer’s shoulders, raising prices. At the same time, the cost of labor resources grows due to high demand. There is not enough workforce to satisfy business needs since vacancies exceed job applicants, and employment grows by 0.5 million people monthly.

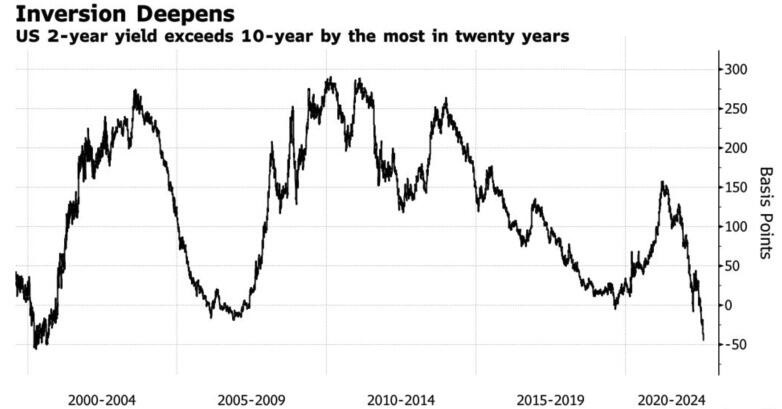

So, there will not be a recession in the nearest time despite the most inverted yield curve since 2000. The Bank of America believes it can become even more inverted, down to the 1980 levels when the Fed’s Paul Volcker raised the federal funds rate to 20% to combat the inflation of 14.8%. Future moves of the yield curve will depend on the Fed and the Fed — on the prices.

Unlike the bond market, the stock market is not thinking about economic downturns. The S&P 500‘s capitalization has grown by $5 trillion from June’s trough and asks point blank: is it another mirage or a start of a bullish cycle? Forecasts for the S&P 500 for the end of the year — +24% and -18% — are opposite. Its moves will depend on inflation. Stakes are high, and the market will not ignore the report.

Bloomberg experts think July’s consumer prices slowed down from 9.1% to 8.7% y-o-y and from 1.3% to 0.2% MoM as gas prices fell and because of other factors. At the same time, core inflation rose from 5.9% to 6.1% y-o-y and dropped from 0.7% to 0.5% MoM.

Trading plan for EURUSD for today

Investors have forgotten that the Fed often said it would not make decisions on one report. I doubt inflation could slow down significantly at the current levels. Its slower growth pace will only produce short-term profits for the EURUSD bulls. So, I suggest selling the pair when it rallies to 1.03 and 1.0355. On the contrary, a surprise inflation growth will suggest a faster-than-expected federal funds rate rise in the next 3-6 months and be a reason for selling the euro in the direction of $1.01 and $1.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.