Only in an ideal world would a rate hike lead to a quick return of inflation to the 2% target. In real conditions, there are time lags. Where will the EURUSD go? Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly EURUSD fundamental forecast

To make money on Forex, one needs to know the trend direction and enter a trade at the right time. Time is a very important factor. When making decisions, investors try to anticipate Fed’s actions based on the US domestic data. The problem is that monetary policy affects the economy with a time lag. And this circumstance must be taken into account when trading EURUSD.

According to IMF studies, changes in interest rates affect GDP in about a year and inflation in three or four years. When former Fed Chairman Paul Volcker quickly raised the federal funds rate to 20% in 1979, it led to an almost instantaneous recession. Still, it took about three years for inflation to return to sustainable levels. According to the Bank of England, a 100-basis-point increase in borrowing costs reduces GDP by 0.6% and consumer prices by 1% in two or three years.

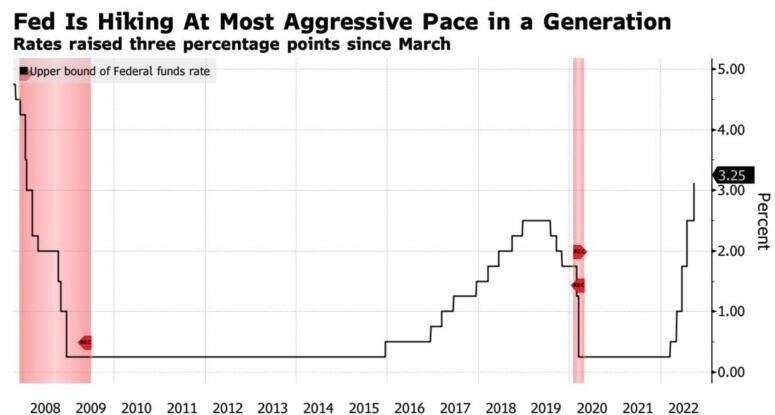

Investors are surprised by two things now. Why does the core inflation in the US continues rising despite the Fed’s aggressive monetary tightening, and why is the economy that strong? According to the consensus forecast of Bloomberg experts, US GDP will expand by 2% in the third quarter, and the model by the Fed of Atlanta signals about 3%. It is assumed that the acceleration of economic growth will be based on foreign trade, which is improving for the fifth month in a row.

Based on the IMF assumption, in 2023, we will not see a significant slowdown in US inflation. Perhaps the US economy will plunge into recession, but prices will continue to remain high. The derivatives market forecast that the federal funds rate will peak at 5% may turn out to be untenable. How the Fed should react if core inflation froze above 5% for the entire year? In my opinion, there can’t be any dovish shift.

Nor should one expect the Fed’s plans to be changed by a recession. It must be very deep for the central bank to return to QE or start cutting rates. Given the current resilience of the US economy, a major downturn seems unlikely. A soft landing is a very good scenario for the dollar. Therefore, the EURUSD downtrend remains strong.

Anything can happen in the short term. Bank of Japan FX interventions, the best weekly rally in the S&P 500 since June, and expectations of a 75-basis-point ECB deposit rate hike at its October meeting due to record inflation in the euro area could push the euro higher. But these are all temporary factors.

Weekly EURUSD trading plan

The BoJ FX interventions failed in September, and the yen should soon weaken. Even the ECB hawks do not see the interest rate above 3%. So, it is still relevant to sell the EURUSD on the rise. If the price doesn’t consolidate at 0.9845, one could enter shorts.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.