The US economy is supported by the retreat of the pandemic, and the central bank may not take into account the events in Eastern Europe. At least, the impact of the conflict in Ukraine is significantly weaker on the USA than the euro area. Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly US dollar fundamental forecast

Markets want to be optimistic, but the situation in Eastern Europe is such that it is dangerous to be optimistic these days. As soon as the topic of negotiations between Russia and Ukraine appears on the agenda, the EURUSD grows. However, everybody understands that the positions of the parties are far from each other, which means that the war will continue. This is a negative factor for the euro.

The options market rates the chances of EURUSD falling to 1.1 over the next three months as two to three, investors are losing patience with a possible ECB rate hike in 2022, and the governor of the Bank of Portugal, Mário Centeno, speaks of growing risks of stagflation in the euro area. Euro bulls are discouraged and one can understand them, the closer you are to the epicentre of the conflict, the worse it is. Another thing is the US economy.

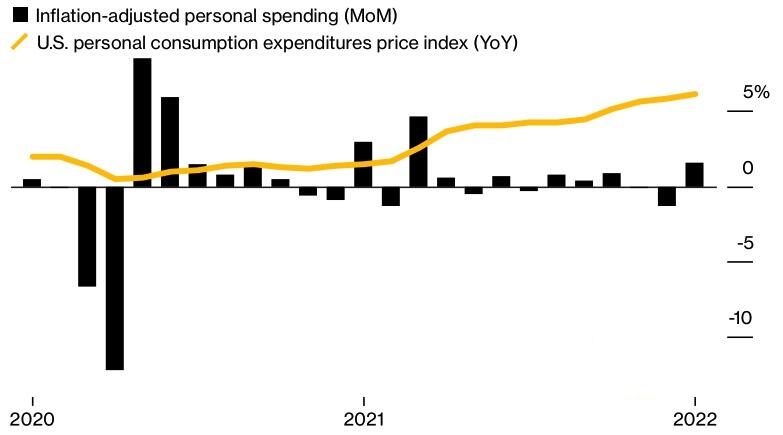

Before Russia launched its invasion of Ukraine, the US economy was actively recovering from another wave of COVID-19. There were many positive reports, inflation accelerated to a 40-year high, and consumer spending in the first two weeks of February increased by 7.2% compared to +2.7% Y-o-Y in the first half of January. By the way, real consumer spending in January jumped by 1.5% M-o-M, which is the highest rate in the last ten months.

Furthermore, Bloomberg experts expect an increase in nonfarm payrolls by 500,000 and a drop in unemployment to 3.8% in February. It is clear that the US economy can withstand the Ukrainian crisis. The Fed does not intend to abandon the start of monetary tightening because of the war in Eastern Europe. Now there is no question whether rates will be raised in March. Investors wonder how much.

Although Christopher Waller and James Bullard suggest raising the central bank’s benchmark interest rate next month by a half-percentage point, most FOMC officials support a more gradual approach. They intend to start small, but if inflation continues to be at elevated levels or accelerates even more, they may act more aggressively. According to Wall Street Journal, a 10% increase in oil prices accelerates inflation in the US by 0.4-0.5 percentage points. Therefore, the above scenario seems quite likely.

Investors wonder if Jerome Powell will talk about a scheme with a slow start and subsequent acceleration of monetary restriction. Markets are used to the fact that the Fed prepares investors for its moves. However, if it does so now, the US dollar should strengthen. Markets are rising on expectations.

Weekly EURUSD trading plan

Therefore, the war in Ukraine, concerns about Powell’s hawkish tone in speeches before Congress and the expectations of strong US jobs report for February create a bearish environment for the EURUSD. Although the major currency pair features short-term rises on the news about the talks between Moscow and Kyiv, there are plenty of sellers in the market to reverse bulls’ progress. Thus, I suggest adding up to the shorts entered before, also on the breakout of the support at 1.117.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.