Democrats urge the Fed to cut rates immediately. Republicans believe that will help the party in power in elections. How should the EURUSD move in this situation? Let’s discuss it and make a trading plan.

Weekly fundamental forecast for dollar

The EURUSD is drifting ahead of important events while Jerome Powell prepares to fight back against Democrats, who demand an immediate fed funds rate cut, and while Donald Trump wins in court, stepping closer to the presidency. Bulls’ attempt to break out resistance at 1.0865 faces their adversary’s fierce resistance. But is it worth attacking so early?

Traders have become more active recently. According to West Virginia University’s research, they open positions six hours before a release of important news and not just one hour before as they used to. They correctly guessed market direction in seven out of twelve important releases, but they are usually at fault when it comes to significant inflation and jobs reports. It is not surprising since inflation is currently the main mystery.

Supporters of an inflation slowdown blame China. The global economy experienced the “China shock” at the turn of the 20th and 21st centuries – a boom of cheap imports from Asia, which kept inflation low in developed countries. History may repeat itself as overproduction in China forces it to increase exports. At the same time, China’s GDP grew fast 25 years ago, but nowadays, it is slowing down, meaning deflation effects are stronger.

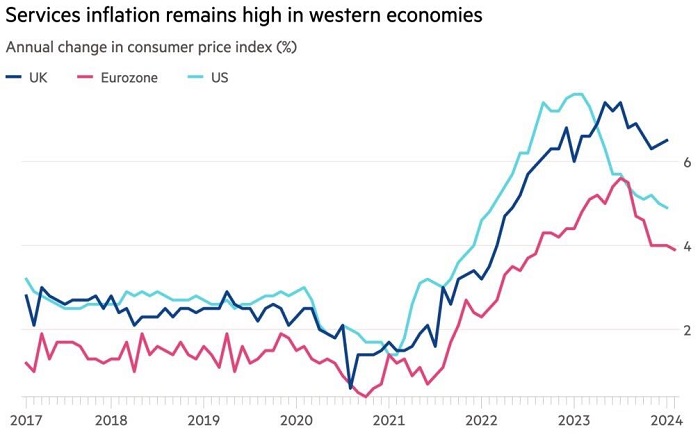

Conversely, advocates of faster consumer prices think a strong labor market increases wages and services inflation. Thus, the last mile of the Fed’s fight against high prices will be the most difficult: inflation can decrease from 9% to 3% easier than from 3% to 2%.

Imagine the Fed’s state: it doesn’t only think about where the PCE and CPI will move but must make the right decision. When and by how much must rates be reduced? At the same time, the central bank is under political pressure. Democrats demand that policy be eased immediately since a quick cooling of the economy is not part of their plans. Republicans argue that if the Fed cuts borrowing costs, it will help the party in power to win elections.

I don’t envy Jerome Powell, but the markets believe in his star. Investors presume the Fed Chair will beat off annoying Democrats in Congress and support the scenario in which monetary expansion starts later in 2024, which is favorable to the USD.

Weekly trading plan for EURUSD

The ECB’s March meeting and the February US jobs report will be more important to the EURUSD. Will the theory that high non-farm payrolls and wages fuel service inflation in the US be confirmed? If yes, the major currency pair will decline, and vice versa. Until then, the euro will nervously move from one side to another. Its failure to hold above $1.0845 may be a foundation for going short.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.