Investors do not believe in the dollar, just like at the end of 2021. However, in 2022 USD dominated Forex. Is it worth underestimating it? Let’s discuss this topic and make up a trading plan for EURUSD.

Weekly US dollar fundamental forecast

At the end of the year, Forex seemed to wake up. EURUSD first fell to 1.0605, then soared to 1.069, after which the pair returned to the middle of the trading range. However, remember that on the eve of the New Year, many traders do not work. As a result, the markets fluctuate wildly due to fewer transactions, which increases volatility. During such periods, the best solution is to calm down, look back at the past, and dream about the future.

The USD entered 2022 far from being the favorite. It was already rising in 2021, and investors believed that its rally was about to end, US inflation would slow down on its own, and the Fed will raise rates slightly. The growth potential of the USD index looked limited. However, everything turned out differently. The federal funds rate rose by 425 bps, and Russia’s invasion of Ukraine increased demand for the USD as a safe-haven asset. According to MUFG, if it were not for the war, the US dollar would have weakened in 2022. This was a major change in the system as it triggered a second global inflationary shock, forcing the Fed to aggressively tighten its monetary policy.

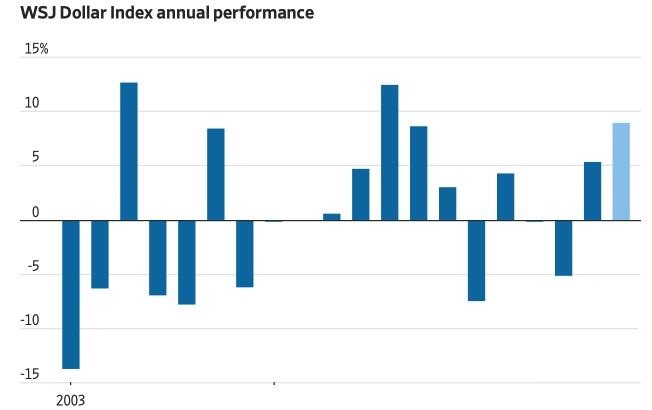

As a result, the USD index from the Wall Street Journal, which assesses the USD’s strength against 16 major world currencies, reached its highest level since September 2001. Even considering the fall in the fourth quarter, the US currency is ready to end the year with the best result since 2014.

The USD strength provoked the weakening of other currencies. The pound fell to a record low, the euro fell to parity for the first time in 20 years, and the yen collapsed to its lowest level since 1990. In October-December, thanks to a slowdown in the Fed’s monetary restriction, currencies partially recovered.

What awaits US currency in 2023? According to many banks and investment companies, the USD will no longer dominate. Eurizon SLJ Capital expects it to weaken by 10-15% amid slowing inflation in the US and investors focusing on the shortcomings of the US economy. Standard Chartered experts believe that the main reason for the USD index decline is the improvement in the growth prospects of other economies. The reopening of the Chinese economy should boost global GDP while fears about Europe’s energy security fade throughout 2023.

In contrast, JP Morgan analysts predict the dollar to rise another 5% as central banks, led by the Fed, continue to tighten monetary policy, while the approach of a global recession will keep safe-haven demand high.

Weekly EURUSD trading plan

In my opinion, the dynamics of EURUSD will be unstable. Initially, concerns about the spread of COVID-19, a strong labor market, and the reluctance of US inflation to decline as quickly as in October-November will support the bears. Later the euro will strengthen. In this regard, use the pair’s fall below 1.061 to enter sales.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.