The recession is about to hit the US, which is bad for the USD. However, when Christine Lagarde surprises the markets with statements that the monetary restriction will soon end, EURUSD begins to weaken. Let’s discuss this topic and make up a trading plan.

Daily Euro fundamental forecast

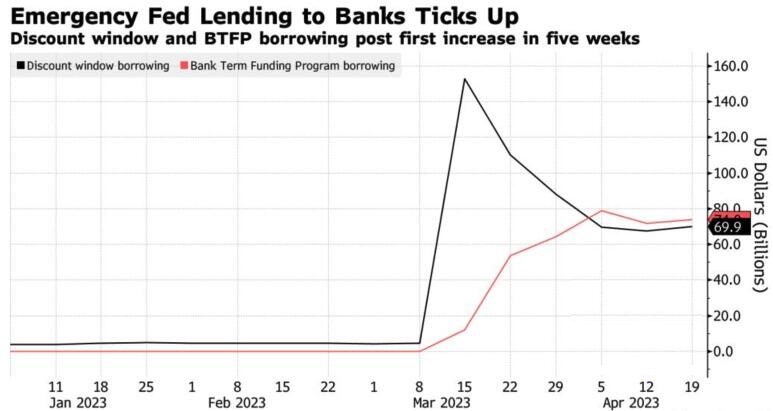

If the US leads the world into a recession, demand for the dollar will fall. Deteriorating macroeconomic data, disappointing corporate reporting, and the first increase in emergency Fed lending in the last five weeks convince us that a recession is a matter of time. If so, then the future of EURUSD bears is gloomy.

Now even such a hawk as Cleveland Fed President Loretta Mester claims that the end of a monetary cycle tightening is close and that further decisions of the central bank will depend on the data. According to the Commonwealth Bank of Australia, the recession will come in the middle of the year. Although inflation remains elevated, the impact of monetary restrictions on the economy with a time lag gives hope that this problem will be resolved.

According to Wall Street experts, the profits of the S&P 500 companies in the first quarter will fall by 6.4%. From January to March 2022, it increased by 10%. At the same time, disappointing corporate reporting forced 11 out of 12 stock index sectors to collapse during the trading session on April 20. Tesla stocks sank 10% after releasing information about a 24% profit drop.

Another negative news contributed to the fall of the S&P 500, the treasuries yield, and the US dollar. Manufacturing activity data from the Philadelphia Fed has collapsed to the lowest levels since May 2020. Recurring jobless claims have fallen to the bottom since November 2021. Home sales on the secondary market have declined 13 in the last 14 months.

The former hawk’s neutral comments, disappointing corporate reporting, weak macro statistics, and growth in emergency lending increase the chances of a recession, as well as attempts by EURUSD bulls to strengthen. Alas, Christine Lagarde spoiled their mood.

The ECB head unexpectedly announced the end of the monetary restriction cycle. According to her, the central bank has already added a significant amount of restrictions, and there is still some work to do ahead. It will depend on a number of factors, including financial problems. Christine Lagarde’s words look unusual, given the expected increase in the deposit rate by another 75 bps to 3.75%. Capital Economics predicts the cost of borrowing at 4%. The company believes that the banking crisis did not allow the ECB to give direct instructions for a rate hike in the future. However, the situation has now stabilized, so the central bank can continue what it started.

Daily EURUSD trading plan

Thus, both the euro and the US dollar need new data. Eurozone PMI data for April could inspire EURUSD bulls to try to break out of resistance at 1.098.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.