Because of the war in Ukraine, energy prices are rising faster in Europe than in the US. This means that the risks of recession and stagflation in the euro area are higher than in the United States. How does this affect the EURUSD? Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

To look into the future, you need to delve into the past. Why did the EURUSD pair show the best monthly growth for a year in May? There are actually two reasons. First, ECB officials, with their hawkish stance, based on concerns about an excessive weakening of the euro, raised the chances of a deposit rate hike by 110 basis points and 180 basis points by the end of 2022 and 2023, respectively. Second, the idea of a pause in the process of tightening the Fed’s monetary policy was actively discussed by investors. However, the ECB is more likely to suspend its monetary tightening than the Fed. If so, the euro rally went too high.

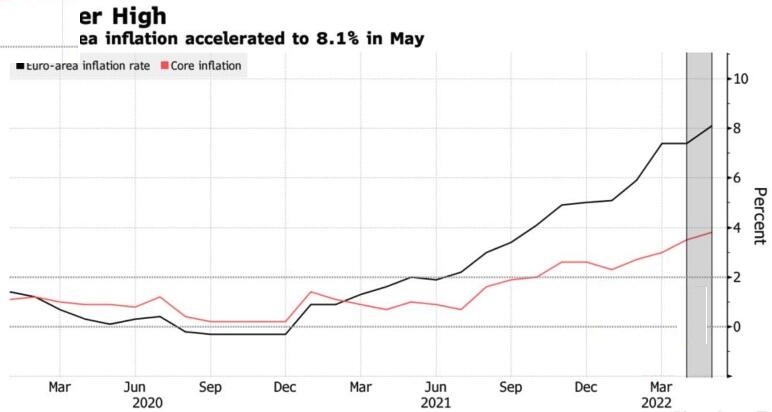

The euro-area inflation has been up to a record high of 8.1%, but investors do not believe the ECB will be that aggressive. Amid the expectations of the ECB monetary tightening, the euro has been falling, which seems strange. Partially, it results from a sell-off on the facts following purchases on the news. In addition, investors understand that the euro-area consumer prices are soaring because of the factors associated with supply problems that the European Central bank can’t affect.

In 2021, energy prices in the US were rising faster than in the euro area. This year, the war in Ukraine has changed the situation. In May, energy costs in the region hit 39.2% (up from 37.5% in April). Anyway, the EU sanctions will keep energy prices high, pushing the euro area into a recession. The ban on Russian oil imports is not a paper tiger, it is a real threat to the euro-area economic growth. Therefore, the ECB could suspend its monetary tightening. Considering the sanctions being imposed, Rabobank expects the euro-area GDP downturn at the end of 2022.

Source: Wall Street Journal.

Another reason for the ECB making a pause after a few rate hikes is the concerns about the euro-area integrity. After the report about record high inflation, Italian bond yields have been rising faster than the German. The bond yield spread has widened, indicating a growing political risk. ECB won’t allow the euro-area break-up.

Weekly EURUSD trading plan

I don’t think the ECB rate will rise by 110 basis points in 2022 and 180 basis points in 2023, as expected by the derivatives. The ECB won’t raise the interest rates that much, considering the concerns about a recession and the turmoil in financial markets. If so, one could add up to the EURUSD short trades entered at level 1.0735 if the price goes below 1.07 and 1.068.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.