The Fed may raise the federal funds rate to 2.5%, and the conflict in Ukraine is far from being over. However, the EURUSD bulls are going ahead. What are the growth drivers and how far will the upward correction go? Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

In December, the FOMC members predicted three federal funds rate hikes in 2022, they expected supply problems to end as the pandemic eased. No one could have imagined that the armed conflict in Ukraine would exacerbate the problem, sending inflation even higher. Furthermore, China’s worst coronavirus outbreak could exacerbate supply pressures. The derivatives market gives a 70% chance of the Fed raising the rate by 1.75% by the end of the year. Bank of America predicts that the Fed will hike the rate five times in 2022 and another four ones in 2023. Why is the euro rising?

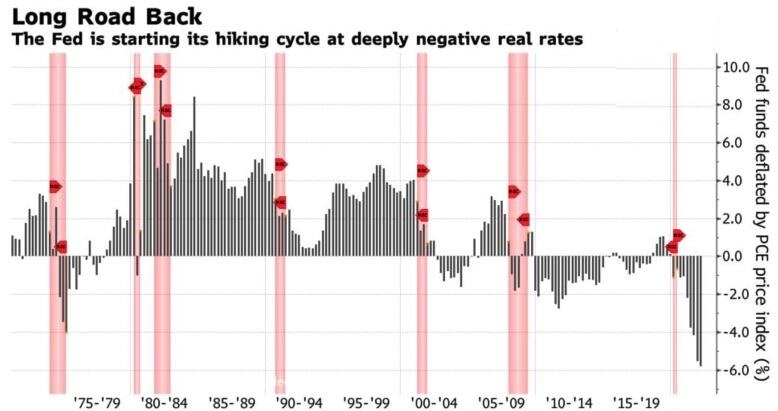

The US labour market is overheated and inflation is soaring. In normal conditions, the central bank would have to hike the rate by half a point at several meetings. However, the current situation can hardly be called normal. Annual inflation expectations, according to the New York Fed, accelerated in February from 5.8% to 6%, which is a record high since the records started in 2013 and a repeat of the November reading. The indicator growth outpaces the increase in the Treasury yields and presses down the real yields. The US is entering the Fed’s monetary tightening cycle with the lowest real Treasury yield since the 1970s. This means the federal funds rate could be raised very high. Most likely, in 2023 it will reach 2.5%.

The Fed may raise the federal funds rate to 2.5%, and the conflict in Ukraine is far from being over. However, the EURUSD bulls are going ahead. What are the growth drivers and how far will the upward correction go? Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

In December, the FOMC members predicted three federal funds rate hikes in 2022, they expected supply problems to end as the pandemic eased. No one could have imagined that the armed conflict in Ukraine would exacerbate the problem, sending inflation even higher. Furthermore, China’s worst coronavirus outbreak could exacerbate supply pressures. The derivatives market gives a 70% chance of the Fed raising the rate by 1.75% by the end of the year. Bank of America predicts that the Fed will hike the rate five times in 2022 and another four ones in 2023. Why is the euro rising?

The US labour market is overheated and inflation is soaring. In normal conditions, the central bank would have to hike the rate by half a point at several meetings. However, the current situation can hardly be called normal. Annual inflation expectations, according to the New York Fed, accelerated in February from 5.8% to 6%, which is a record high since the records started in 2013 and a repeat of the November reading. The indicator growth outpaces the increase in the Treasury yields and presses down the real yields. The US is entering the Fed’s monetary tightening cycle with the lowest real Treasury yield since the 1970s. This means the federal funds rate could be raised very high. Most likely, in 2023 it will reach 2.5%.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.