Markets were dreaming of a Fed’s dovish reversal due to a recession in the US economy. However, recent data suggests that the US will avoid a downturn. This leads to a EURUSD correction. Will it be long-lasting? Let’s discuss this topic and make up a trading plan.

Weekly Euro fundamental forecast

The market predicted a recession in the US economy. Therefore, investors started considering lowering the federal funds rate as early as 2023, although the actual reasons may differ. This is what always happens when you act on emotions. As a result, EURUSD rose too high. It’s time to return from heaven to earth.

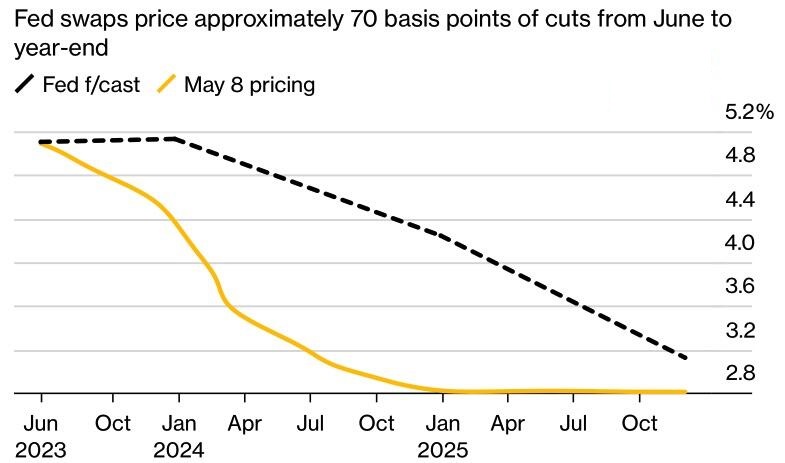

Strong US employment data for April made the market question the economy’s diagnosis. If there is no recession, the Fed could keep borrowing costs at the high of 5.25% long enough or even increase it. Not surprisingly, the chances of a federal funds rate cut in September fell from 90% to 75% and then to 67%. Before releasing employment data, derivatives estimated the probability of the July monetary expansion as fifty-fifty. Now it is 1 to 3.

Without a recession, 10-year Treasury yields (which indicate the average Fed rate in 2024-2033) could rise from the current 3.5%. It is already starting to grow. Moreover, following Barclays, Goldman Sachs officials announced that the borrowing cost would remain at 5.25% until the end of 2023.

A decrease in the probability of a dovish reversal and an increase in the treasuries yield allowed the EURUSD bears to lower quotes below 1.1. The quarterly senior loan officer opinion survey also strengthened the US dollar. It turned out not to be as bad as the market expected. In January-March, 46% of banks tightened lending conditions compared to 44.8% in October-December.

Markets continue to worry about the recession, banking crisis, and potential default. However, if credit institutions are stable and the problem with the debt ceiling is resolved as usual at the very last moment, EURUSD bears will be able to develop a correction.

Moreover, not everything is stable in the eurozone. The Sentix investor sentiment index unexpectedly worsened in May, while German industrial production fell 3.4% from March. ING notes that the negative dynamics of the indicator will lead to a decrease in the eurozone GDP estimate for the first quarter (which is already close to zero). Thus, a technical recession may hit the eurozone.

According to ECB Chief Economist Philip Lane, high inflation should decrease by the end of this year due to easing of major shocks and monetary tightening. The latter, perhaps, is ending, depriving the euro of almost its main advantage.

Weekly EURUSD trading plan

Not slowing down inflation in the US, a decrease in the possibility of a recession in the US economy, and a dovish reversal by the Fed will contribute to the development of a EURUSD correction. Add up to short trades entered in 1.104-1.1055 in case of a successful test of support at 1.097.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.