The Fed’s hawkish shift last autumn strengthened the US dollar. In spring, the same happened with the ECB and the euro. Investors are looking forward to the Governing Council meeting. Let us discuss the Forex outlook and make up a EURUSD trading plan.

Euro fundamental forecast today

The more urgency shows Christine Lagarde, the more encouraged will be the EURUSD bulls. The ECB president a few days ago outlined a plan to bring the deposit rate out of the negative area by the end of the third quarter, but the situation is such that today it can be adjusted. Although the ECB members have repeatedly said that the rate won’t be raised before the end of QE, BMO Capital Markets gives a 20% chance that it will rise at the Governing Council June meeting. If so, the euro will surge to $1.1.

For a long time, the ECB did not recognize the acceleration and a long period of high inflation, which made it one of the most dovish central banks in the world. In the spring, Christine Lagarde and her colleagues finally realized that prolonged inactivity would have dire consequences. There has been a hawkish shift, similar to what happened with the Fed last autumn. Then the US dollar rose, and now the euro does.

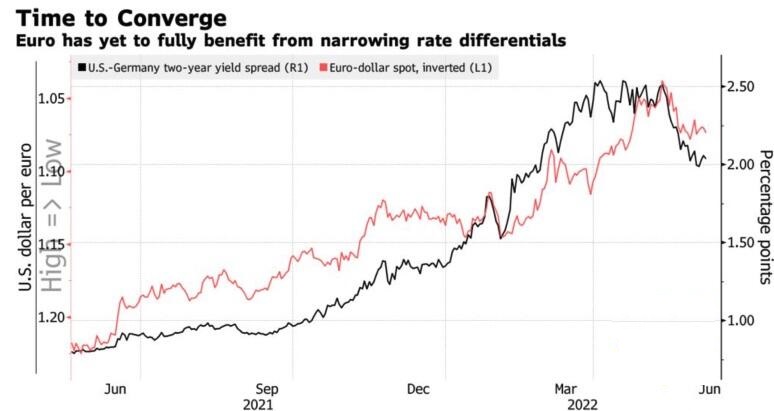

Both currencies rose because of the bond yields rally. Germany’s 10-year yield has been rising at the fastest pace in a century over the past six months! As a result, the spread with the US 10-year yield has narrowed, signalling the EURUSD should be trading at 1.09.

The Fed’s monetary tightening has been priced in the USD exchange rate. At the same time, analysts expect the ECB to raise the rate not by 15 basis points, as was supposed in January, but by 135 basis points. Moreover, Janet Yellen talks about easing Chinese import tariffs by expanding the list of goods that are not subject to duties. Once, the US-China trade war significantly strengthened the greenback. Now, the USA is moving towards globalization, supporting the currencies of the export-led economies.

On the other hand, the euro buyers should consider a new round of the energy crisis at the end of 2022, the cost of living crisis, and stagflation. Black Rock believes the ECB is on the right track with inflation, but the fragile economy and the heightened sensitivity of heavily indebted countries to rate hikes will force it to slow down monetary tightening. The company is talking about a pause in 2023, but the markets are more interested in what will happen here and now.

EURUSD trading plan today

Morgan Stanley sees the EURUSD at 1.1, while Rabobank suggests the pair should be sold unless Christine Lagarde says something unexpected. Currently, investors expect the end of the QE, the monetary tightening in July, and bringing the deposit rate from the sub-zero area by late September. The euro needs a fresh driver to break out $1.076. Otherwise, the EURUSD could go below 1.065. The euro’s future trend will be clear only when the price goes out from the trading corridor. I think the price movement will be limited by levels $1.05 and $1.09.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.