A strong US dollar is just one reason for the EURUSD downtrend. The EU is about to ban the import of Russian oil, pressing down the euro. Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

While Forex traders are wondering whether the Fed will be more hawkish than currently assumed or it will signal a pause if the economic data are worse, there has been a historic event in the market. 10-year Treasury yield has been up above 3% for the first time since late 2018. Yields on 20-year securities rose first, and a little later in April, increased the yields on 5-year, 7-year, and 30-year papers. Investors understand that markets are returning to normal as the federal funds rate increases and the huge mass of cheap liquidity is withdrawn. These circumstances encourage the EURUSD bears.

Ten-year Treasury yields were well above 3% for most of the past half-century, exceeding 15% in the 1980s. But in the past decade, they have ended the day above 3% only 64 times, reflecting a period that until recently was marked by sluggish growth and inflation.

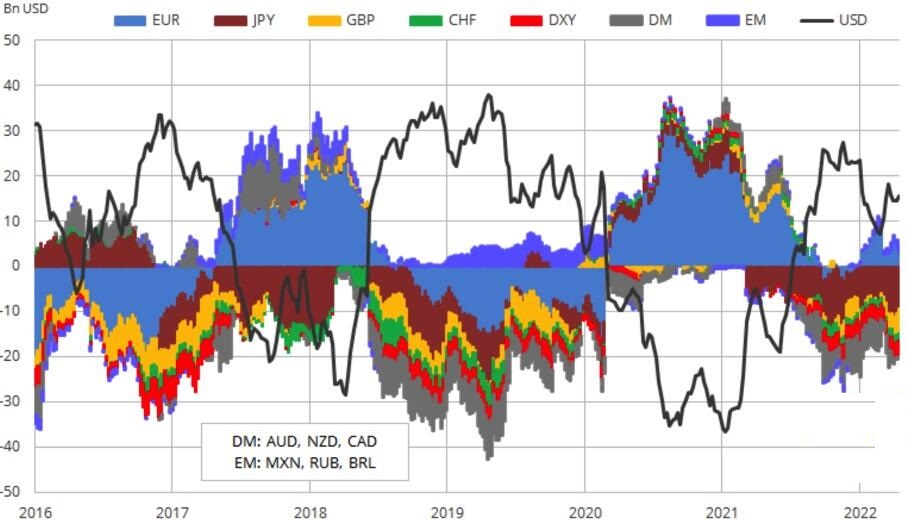

In 2022, the situation has changed radically. Treasury yields are skyrocketing, fueling the strength of the US dollar. In April, the USD index recorded its best monthly gain since January 2015. At the same time, speculators increased the greenback net longs for the first time in four weeks, which allowed Scotiabank to assert that the US dollar rally would continue because investors did not fully participate in its upward movement in April. USD net long positions are far from extreme values, which suggests the currency should be growing in value.

The EURUSD has been down to a five-year low, and the reason is not only a strong dollar but a weak euro as well. The euro-area energy is worsening as the EU is about to join the US embargo on Russian oil imports. The decision can be taken in early May already. Slovakia and Hungary, which are particularly dependent on the supply of Russian oil, will be given additional time to join the import ban. Earlier, Germany, which opposed it, stated that it had reduced the share of Russian oil in the structure of imports from 35% at the time of the beginning of the Russian invasion of Ukraine to 12%, the share of gas over the same period decreased from 55% to 35%. At the same time, Germany is increasing energy purchases from the United States, Norway, and the Gulf countries.

Weekly EURUSD trading plan

Still, the meeting of EU officials is overshadowed by the FOMC meeting, when the federal funds rate could be raised by half a point. Furthermore, the derivatives market signals 50-basis-point hikes at the next two meetings. I don’t think Jerome Powell’s hints at the further rate hikes will strengthen the US dollar. I suppose the greenback will be sold on facts. Therefore, I still recommend selling the EURUSD on the breakout of the support at 1.049. Next, it might be relevant to exit shorts and be prepared to enter purchases.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.