Market sentiment changes often, but this does not prevent EURUSD from growing. Investors are discussing the possibility of raising the deposit rate by 50 bps in May and further increasing it to 4%. Let’s discuss this topic and make up a trading plan.

Weekly Euro fundamental forecast

Divergence in monetary policy in action! It would seem that the euro has no new growth drivers, and the strength of the US economy is underestimated, which slowed down the EURUSD rally. However, the main currency pair grew after ECB officials began discussing higher rates than the market expected, and First Republic reports reminded of the banking crisis. If the Fed ends the monetary restriction cycle and the ECB sticks to its line, the euro will continue strengthening against the US dollar.

The head of the Bank of Belgium, Pierre Wunsch, said investors underestimate how high the ECB’s deposit rate could rise. He won’t be surprised if it rises to 4% instead of the 3.75% expected by the market. The European regulator won’t pause until it sees wage growth and core inflation slow down along with consumer prices.

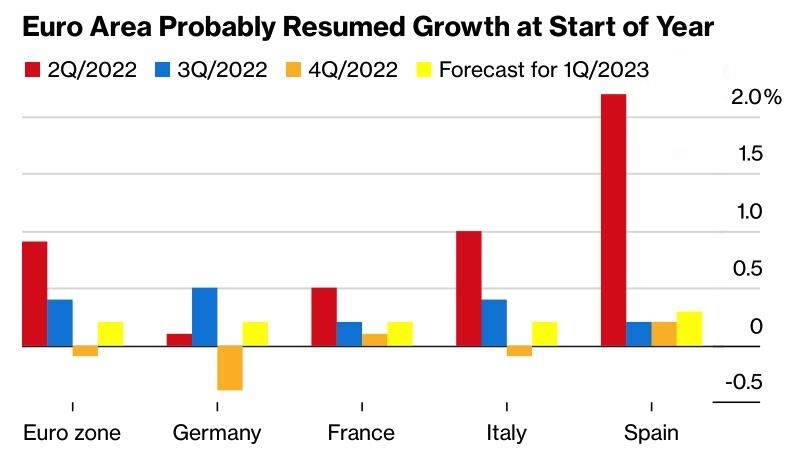

Member of the Governing Council Isabel Schnabel does not rule out a 50 bps borrowing costs increase at the May meeting. Everything will depend on the data in a month. Now inflation is higher, and the economy is more stable than expected. According to Bloomberg, the resilience of the economy means that a tight labor market will keep core inflation high for longer than the ECB would like. The eurozone is expected to avoid recession while its GDP expands by 0.2% QoQ in the second quarter. All leading economies of the currency union will continue to grow.

The derivatives market estimates the chances of a deposit rate increase in May by 25 bps as 2/3 and by 50 bps as 1/3. 57 out of 69 Reuters experts are in favor of the first option, and the remaining 12 are in favor of the second. This means that the euro rally still has the potential to continue. If the new eurozone GDP data for the first quarter and the German inflation data for April are pleasantly surprising, the market will increase the possibility of the ECB’s seventh consecutive move by at least half a point in May, which will trigger EURUSD growth.

Moreover, after the release of new corporate reports, investors will again discuss the chances of a recession in the US and a Fed’s dovish reversal.

First Republic is little America. The bank managed to cope with the outflow of deposits, but it cost him dearly. Its net interest margin fell from 2.45% to 1.77% in the first quarter. This means that the bank continues to struggle for survival. The banking crisis is not over, so it is still too early to say there will be no recession in the US economy.

Weekly EURUSD trading plan

Investor sentiment changes extremely often, so it would not be surprising if, after updating the April high, EURUSD fails to consolidate there and declines. Especially if US GDP for the first quarter is better than expected. Hold long trades entered at the levels of 1,1 and 1,098.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.