The currency’s stability before the release of negative news suggests that its rate is ready to grow. The EURUSD fall against the backdrop of negative looks modest. Will the euro uptrend resume, or will the correction continue? Let’s discuss the topic and make up a trading plan.

Daily Euro fundamental forecast

Judging by the way EURUSD reluctantly declines against the background of a hawkish Fed, protests, and deteriorating business activity in China, as well as a slowdown in European inflation, it becomes clear that Jerome Powell is going to make a monumental effort to change everything. The market wants to grow, but the euro is not afraid even of the reduced probability of a 75 bps increase in the ECB deposit rate in December from 50% to 30%. Will the Fed chairman disappoint the optimists?

The slowdown in German consumer price growth from 11.6% to 11.3% supported proponents of a slower tightening by the ECB. Especially since the Spanish CPI has been slowing down for the fourth month in a row. If the eurozone inflation has stopped growing, there is less argument in favor of another gigantic rate hike, while European bond yields are declining. These factors contribute to the EURUSD decline.

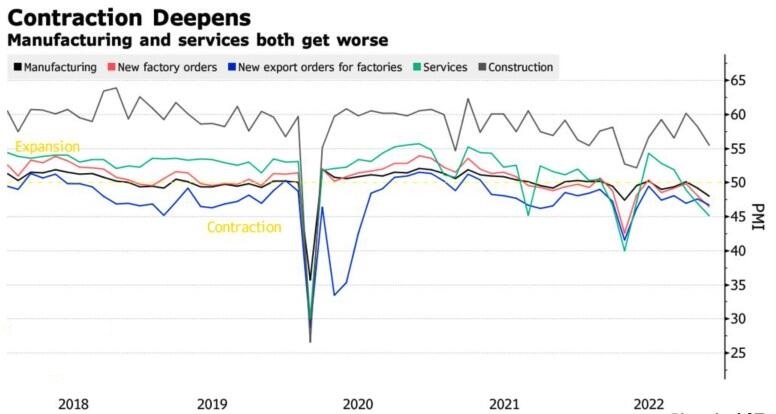

However, after falling to the zone of 1.0325-1.033, EURUSD began to rise again after the release of a weak Chinese PMI. ISM Manufacturing PMI declined to level 48, the lowest since April. It fell short of Bloomberg experts’ forecasts, as did PMI in the construction and services sectors.

Indicators in the zone below level 50 signal a GDP contraction and an increase in global recession risks. This is good news for the US dollar as a safe-haven currency.

However, EURUSD rebounded again from 1.0325-1.033, proving where key support is situated. It also confirmed my point that the $1.033 level serves as the red line for the euro.

EURUSD moved away from the level of 1.05. Several factors contributed to this. First, aggressive statements by FOMC officials that the fight against inflation will continue until 2024. Second, the opinion that the market is wrong about the degree of Fed aggression. Third, consolidation of high prices in the world economy due to deglobalization. However, for the decline to continue, Jerome Powell needs to be extremely hawkish if he wants to tighten financial conditions and defeat the highest inflation in decades.

If the Fed president announces only a higher peak federal funds rate compared to the FOMC’s September forecasts, the S&P 500 risks rising higher, dragging EURUSD along with it. Until then, the euro should withstand the release of European inflation data, but it seems that this will not happen.

Daily EURUSD trading plan

Thus, Jerome Powell’s super hawkish speech will push EURUSD below 1.0325, which will allow adding up to the short trades entered at 1.0385. On the contrary, the pair’s growth above 1.039-1.0395 is a reason for a reversal.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.