The EURUSD was trading in the range of 1.13 – 1.135 before the introduction of Russian troops into Ukraine and, most likely, will return to these levels after their withdrawal. The conflict is far from the end, so the euro bulls are held back. Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

The longer the war lasts, the higher the costs. EURUSD traders should be guided by this phrase by Christine Lagarde, which explains why the ECB’s monetary normalization will be gradual. Although the example of a US stocks rally in the second half of March is encouraging and reinforces the desire to do the same with the euro, buying hope is hardly justified at present.

The talks about the withdrawal of Russian troops from the territories adjacent to Kyiv allowed the single European currency to soar to a monthly high against the greenback. However, the Kremlin announced that the Istanbul negotiations had not brought the opponents closer to an agreement that would end the armed conflict, and the EURUSD bulls have been set back. In theory, the end of the conflict in Ukraine should return the price into the range of 1.13 – 1.135. The war is far from the end, so the euro rally looks limited.

The costs are really high. A monthly survey conducted by the EU showed that sentiment among businesses and households has declined to its lowest level in almost a year. They are still higher than at the peak of the pandemic, but the armed conflict in Eastern Europe put an end to the multi-month growth of the indicator. In Germany, a group of economists advising the government reduced its 2022 GDP forecast from 4.6% to 1.8%. Such a sharp cut suggests that if not for the recovery from COVID-19, the German economy would definitely slide down into a recession.

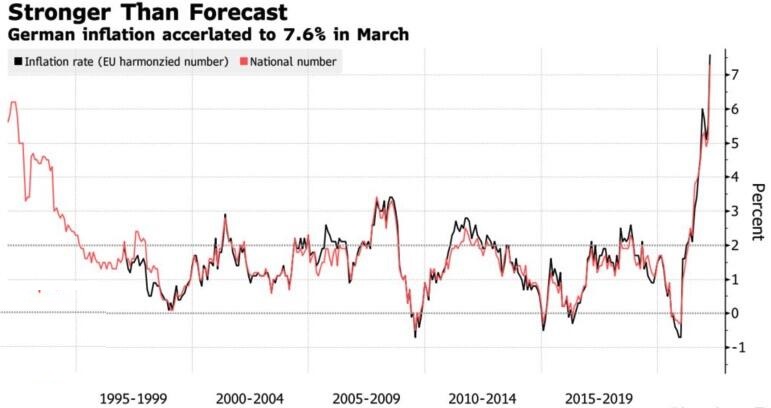

The situation is exacerbated by the rise in consumer prices to 7.6% in March, which is significantly higher than the median estimate of Bloomberg experts at 6.8%. At the same time, only one specialist out of 27 participating in the survey gave a higher forecast.

The risk of stagflation in the German economy is really high, although the ECB policymakers are claiming the opposite. The task of the European Central Bank is clear but complicated. For the Fed, it looks simpler. Many FOMC officials are pushing for the need to quickly bring the federal funds rate to a neutral level of 2.4-2.5%, and then pause and see how the US economy reacts to monetary tightening. The president of the Federal Reserve Bank of Kansas City, Esther George, and the chief executive officer of the Federal Reserve Bank of Philadelphia, Patrick Harker, have joined this idea. Tom Barkin, the president and CEO of the Federal Reserve Bank of Richmond, says the Fed should raise the rate by half a point if the incoming data continue to be strong.

The inverted yield curve doesn’t seem to bother the Fed. The White House claims the US economy is strong and can withstand the monetary tightening cycle.

Weekly EURUSD trading plan

Therefore, the EURUSD rally is losing momentum as investors realise that the Ukrainian conflict is far from being eased. So, a higher chance of the federal funds rate hike by half a point supports the euro bears. If the EURUSD fails to consolidate above 1.1165, it will be relevant to sell.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.