The weakness of the euro-area economy pressed down the EURUSD. Furthermore, the US dollar is supported by the US exclusivity and the Fed’s unwillingness to cut the rates. Let us discuss the Forex outlook and make up a trading plan.

Weekly Euro fundamental forecast

If the monetary policy of the world’s leading central banks depends on the incoming data, then you can’t imagine a better environment for trading on the news. The market principle of “buy the news, sell the fact” is working, as evidenced by the latest up-and-downs in the EURUSD. Investors expected positive news from the euro-area PMI, and as soon as they received it, they began to sell the euro.

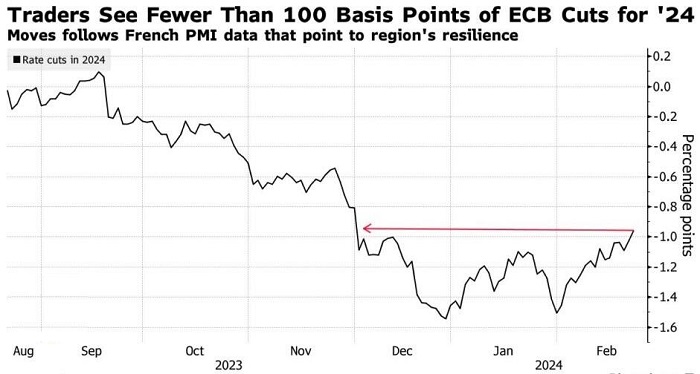

The growth of the services PMI above the critical level of 50 for the first time in six months and stronger data on the manufacturing PMI than expected pushed EURUSD up to the previously indicated target of 1.088. Investors immediately decided that the euro-area was recovering and the worst was over. The main problem is Germany, while the economies of other eurozone countries are recovering. As a result, the derivatives market reduced the forecast for the scale of the ECB’s monetary expansion to less than 100 basis points in 2024 and moved the start date from April to June. It means the same trajectory as the Fed. It is not surprising that the euro surged.

In fact, February PMI data suggests that even in a best-case scenario, the eurozone economy will experience weak growth in the first half of the year. In general, according to Capital Economics, it can be called stagnant. How can the euro grow in such conditions!? Moreover, the US dollar is supported by the strongest US manufacturing PMI since September 2022 and the hawkish comments of Fed officials.

According to Federal Reserve Vice Chairman Philip Jefferson, excessive easing of monetary policy could delay or reverse the process of achieving price stability. He expects the federal funds rate to be cut at the end of 2024. Christopher Waller believes that after the latest inflation data, the Fed needs to be patient and cautious. Philadelphia Fed Governor Patrick Harker believes monetary expansion could begin at some point this year. But not now.

New record highs for US stock indices also discouraged the EURUSD bulls. The growth in stock indexes is generally perceived as an improvement in global risk appetite, which supports the euro. However, it does not work at the end of winter. Both the dollar and the S&P 500 are rising thanks to US exceptionalism. This is reflected not only in the strength of the economy but also in the impact of artificial intelligence technologies, of which NVIDIA is the embodiment. Investors are realizing that now is the time they need to buy US stocks.

Weekly EURUSD trading plan

Thus, the US dollar has lost a driver, but others are still working on the side of the EURUSD bears. The euro is too weak to reverse the downward trend. This increases the risks of consolidation of the main currency pair in the range of 1.077-1.088 and creates. I suggest selling on growth and buying on the decline at the upper and lower boundaries of the trading range.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.