Markets believed in a 75-basis-point federal funds rate hike, which, coupled with Jerome Powell’s statement that he does not expect such moves in the future, allowed EURUSD to hold above 1.04. What’s next? Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

Based on investors’ reaction to the first 75 bp increase in the federal funds rate since 1994, markets approve of the Fed’s aggressive policy. Stocks rose, and US Treasury yields fell after the Fed took a seemingly desperate step. I suppose investors are tired of being worried. The expectations of important events are more influential than the events themselves. Ahead of the FOMC June meeting, the situation was so tense that an increase in borrowing costs by 100 basis points could not be ruled out. The central bank raised the rate by 75 basis points, and Jerome Powell decided to refrain from being too aggressive. That is why the EURUSD hasn’t gone below the critical level.

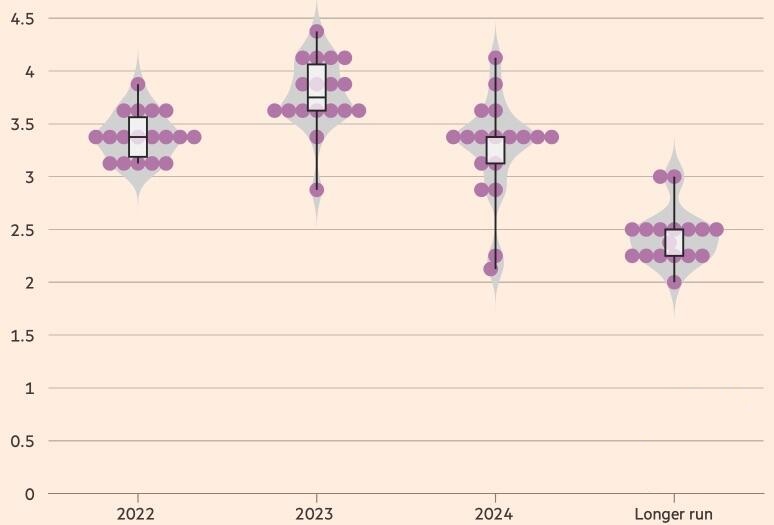

The Fed is focused on inflation, which is a lagging indicator, in fact. Trying to catch up with it, the regulator can’t but speed up monetary tightening. The FOMC June median forecasts for the federal funds rate assume it will rise to 3.4% by the end of 2022. This is equivalent to another 175 bps, that is, at least one more 75 bps hike at one of the remaining meetings this year. In 2023, borrowing costs will rise to 3.8%, which is well above the neutral level, which neither slows down nor accelerates economic growth.

Markets believed in a 75-basis-point federal funds rate hike, which, coupled with Jerome Powell’s statement that he does not expect such moves in the future, allowed EURUSD to hold above 1.04. What’s next? Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

Based on investors’ reaction to the first 75 bp increase in the federal funds rate since 1994, markets approve of the Fed’s aggressive policy. Stocks rose, and US Treasury yields fell after the Fed took a seemingly desperate step. I suppose investors are tired of being worried. The expectations of important events are more influential than the events themselves. Ahead of the FOMC June meeting, the situation was so tense that an increase in borrowing costs by 100 basis points could not be ruled out. The central bank raised the rate by 75 basis points, and Jerome Powell decided to refrain from being too aggressive. That is why the EURUSD hasn’t gone below the critical level.

The Fed is focused on inflation, which is a lagging indicator, in fact. Trying to catch up with it, the regulator can’t but speed up monetary tightening. The FOMC June median forecasts for the federal funds rate assume it will rise to 3.4% by the end of 2022. This is equivalent to another 175 bps, that is, at least one more 75 bps hike at one of the remaining meetings this year. In 2023, borrowing costs will rise to 3.8%, which is well above the neutral level, which neither slows down nor accelerates economic growth.

Weekly EURUSD trading plan

Thus, the Fed and the ECB managed to calm the financial markets, which may lead to some short-term consolidation of EURUSD in the range of 1.037-1.051. We can determine the future trend only when the price exits the consolidation range. In the meanwhile, I don’t recommend entering medium-term trades.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.