The euro has a great number of problems: political and energy crisis, recession, and a lower global risk appetite. What’s next? Will the EURUSD be corrected up? Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

Over the past few months, the euro has faced a lot of problems. There is the war in Ukraine, energy crisis, political issues in Italy, approaching recession, and lower global risk appetite. The EURUSD used to reach parity, and the derivatives market gives a 70% chance that the pair will return to it before the end of the year. JP Morgan and Rabobank predict that the euro will fall to $0.95. However, the problems seem to be easing.

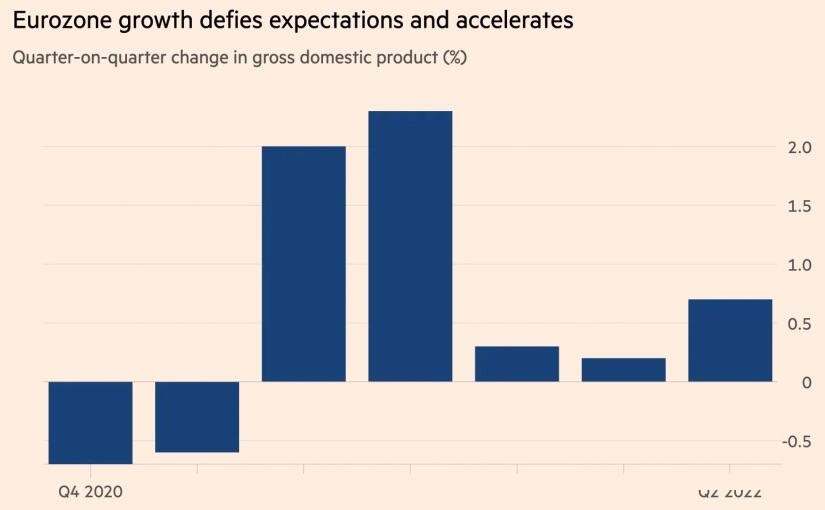

The euro-area economy seems rather resilient to foreign negative. Following the post-pandemic economic recovery, the GDP grew by 0.7% Q-o-Q in April-June, equivalent to 2.8% on an annual basis. In the first quarter, it was 2%. Furthermore, the US and China’s GDPs are contracting, so the euro-area economy performed quite well in the first quarter compared to other advanced economies.

The stability of its GDP against the backdrop of record high inflation gives the ECB a free hand. The central bank may tighten monetary policy more aggressively than currently anticipated. In general, one should understand that an overly strong US dollar is forcing the Fed’s rival central banks to respond by accelerating the pace of monetary tightening since there are no alternatives. Coordinated foreign exchange interventions are impossible without the participation of the US central bank, and the Fed is quite pleased with the inflation-restraining power of the greenback. However, the markets do not agree with this.

Investors are going against the Fed. Contrary to Jerome Powell’s indication of the latest FOMC forecast for the federal funds rate, which sees it rise to 3.8% in 2023, markets expect the ceiling to be 3.3%. In 2023, investors expect a rate cut. The reason is the approaching recession, as evidenced by the drop in US GDP in the first and second quarters. At the same time, markets believe that June’s 9.1% inflation is the peak; in the future, consumer prices will decline even without the participation of the Fed. Deutsche Bank expects the inflation rate to fall to 3.3% in 2023.

The Fed aims at pressing down the labour market and thus reducing the wage growth, which continues to fuel inflation. Judging by the slowdown in employment growth in July from 372,000 to 250,000 predicted by Bloomberg experts, the Fed is going to achieve the aim. If the employment growth rate falls to 150,000, investors will sell off the US dollar.

Carry traders could also weaken the greenback. Since the beginning of the year, the return from trading the difference in prices using the weak euro as a funding currency has reached 29%. If risk appetite continues to grow and EURUSD corrects up, there will be a shift from the euro to the US dollar used as a funding currency, contributing to the euro’s upward correction.

Weekly EURUSD trading plan

So, the EURUSD can well continue rising. If the price breaks out the resistance level of 1.0255 and 1.027, it will be relevant to buy the major currency.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.