When there is only bad news around, you get used to it. Positive news becomes a reason for optimism and also makes speculators get rid of the US dollar as a safe-haven currency. Let’s discuss the topic and make up a trading plan for EURUSD.

Weekly Euro fundamental forecast

It’s hard to be optimistic during a pandemic, the highest inflation in decades, shortages of goods, and war. However, when everyone says that the situation is hopeless, one would like to believe that the Fed will be able to avoid recession thanks to a strong labor market. That warm weather will help save the eurozone from recession. That China can end Covid restrictions ahead of schedule. The optimistic news allowed the EURUSD to soar to 3-month highs. However, won’t the EURUSD rise turn out to be false?

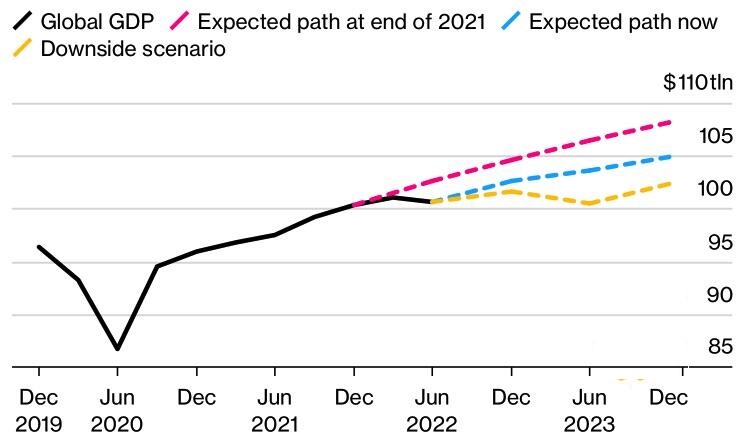

The EURUSD downtrend is based on pessimistic forecasts. They remain so now, but the demand for the euro rises sharply when there is hope. Bloomberg predicts a recession in the US economy in the second half of 2023 and a slowdown in GDP from 1.8% to 0.7%. The forecast for the eurozone (-0.1%) is even worse. The recession is very modest, thanks to expectations of a mild winter and fiscal aid from governments. However, in the worst-case scenario, the economy will contract by 3.3%. As a result, global GDP could contract by 0.5% in 2023, with a baseline growth of 2.4%.

The pandemic has significantly reshaped labor markets, raising the natural unemployment rate. This indicator is necessary to return inflation to the target of 2% to 4% or even 5%. In the second case, according to Bloomberg models, the Fed will have to raise the federal funds rate to 6%, which could trigger a deep recession.

However, FOMC officials and markets are guided by the natural unemployment rate of 4%, at which the peak cost of borrowing will not reach 5%. Although Jerome Powell said after the November FOMC meeting that the rate ceiling would be higher than the 4.6% expected by Fed officials, it may turn out differently. Everything will depend on the data. This was emphasized by Fed Vice Chairman Lael Brainard. In her opinion, a slower pace of monetary tightening is necessary, as it will give the Fed more time to study the impact of the restriction on the economy.

The EURUSD fate will depend on the level and speed of the Fed and ECB rate hikes, and the regulators’ decisions on incoming data. The market has been pessimistic for a long time, don’t be surprised at its violent reaction to good news. The euro rally may continue against the background of a further improvement in global risk appetite. However, remember that the US economy is still strong, the Fed still hasn’t done its job, and a cold snap in Europe could cause the energy crisis to deepen.

Weekly EURUSD trading plan

Considering all the risks, it is reasonable to enter EURUSD short-term sales following the breakout of support at 1.027. On the contrary, a successful breakout of resistance at 1.036 will strengthen the uptrend and allow increasing or entering EURUSD long trades.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.