EURUSD cannot ignore the numerous positive signals from the Chinese and global economies, US stock indices, and the ECB. In addition, the euro is at the bottom of the disappointment cycle. Let’s discuss this topic and make up a trading plan.

Daily US dollar fundamental forecast

Everything is calm in Forex. The euro is trying to strengthen due to the continuation of the rally in US stock indices, improved forecasts for the global economy, and positive Chinese data. The PBC cut its seven-day buyback rate by ten bps to 1.9% for the first time since August 2022. At the beginning of the year, the markets were highly euphoric about the upcoming rapid recovery of the Chinese economy. Now investors have given up this idea. However, the return of old narratives will help not only the yuan but also the EURUSD.

At the beginning of 2023, the resilience of the US economy to the Fed’s aggressive monetary restriction formed the basis for the EURUSD correction. In May, the situation repeated itself due to the strength of the US labor market. However, other data point to a cooling economy. Investors are selling EURUSD because of American exceptionalism. Aren’t they too excited about it?

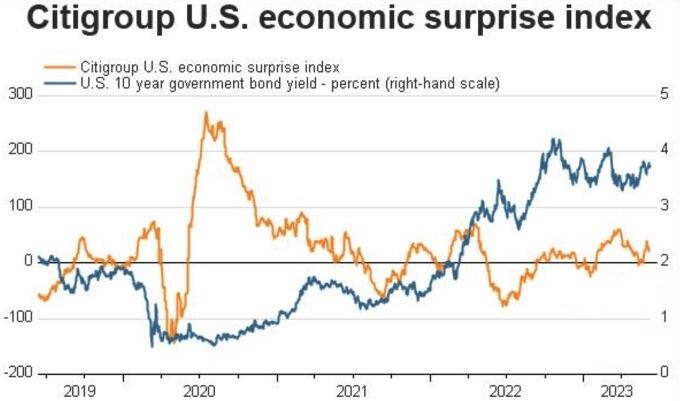

It is curious that the economic surprise index, an indicator showing the ratio between actual and forecast data, restores its correlation with the treasury yield. If US macro statistics are more disappointing than encouraging, debt rates will decrease, negatively affecting the US dollar.

The euro, on the contrary, is at the very bottom of the disappointment cycle. Recession hit eurozone at the turn of 2022-2023, Chinese data upsets, Germany hampers production capacity if Russian gas stops flowing to Europe after 2024. These negative data made investors think that there would be no more positive. However, the World Bank raises its global GDP forecast, Goldman Sachs reduces recession risks in the US economy from 35% to 25%, the IMF does not expect a UK recession, and Reuters experts predict a moderate recovery in the eurozone.

The eurozone is an export-oriented region. Therefore, good news from the global economy tends to strengthen the EURUSD. Moreover, the rally in US stock indices indicates an improvement in global risk appetite, and the ECB is going to raise the deposit rate by 25 bps to 3.5%.

Thus, the EURUSD uptrend should start to recover soon. The main thing is that the Fed does not interfere. Its officials act according to the data. If actual data on consumer prices and core inflation for May are higher than forecasts of 4.1% and 5.2%, the chances of a rate hike in June will increase, which will strengthen the US dollar.

Daily EURUSD trading plan

On the contrary, a more serious slowdown in US inflation than expected will finally convince the markets of the Fed’s pause and make EURUSD purchases at 1.0815 and 1.084 reasonable. After that, investors are likely to take profits in anticipation of the verdict of the central bank.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.