The rise in the euro-area inflation has made the ECB’s doves sound hawkish. However, it is not enough when the Fed is willing to aggressively tighten monetary policy. If so, what supports the EURUSD bulls? Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

It was easy to be a dove before the pandemic. Now, when inflation is extremely high, it is easy to be a hawk. However, investors are focused on the speed of the monetary tightening rather than on the fact of its start. Markets also wonder how high the central banks’ interest rates will climb. The EURUSD correction reflects the investor sentiment.

Until now, investors have been convinced that the Fed will move faster than the ECB. Christine Lagarde has been talking about a gradual tightening of monetary policy over and over again, while Jerome Powell has drawn a clear plan. The Fed is to raise rates in June and July by 50 basis points. Governing Council member Klaas Knot says a further acceleration of inflation in the euro area could be the basis for a rate hike by the European Central Bank in July. It is the first example to challenge the regulator’s commitment to a gradual tightening of monetary policy. The European bond yields increased sharply, sending the EURUSD up.

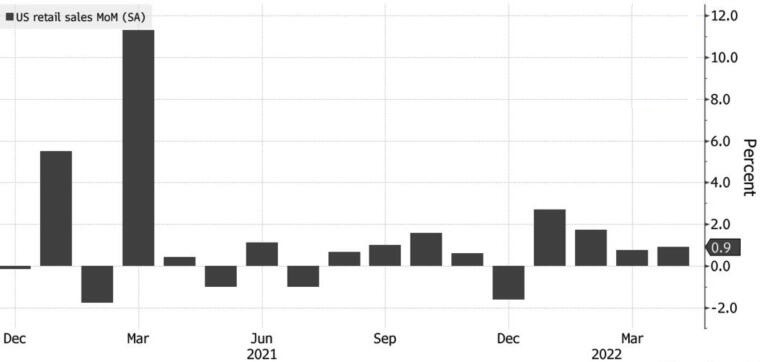

The dollar buyers were disappointed by Chicago Fed President Charles Evans, who said he supports a shallower rate-hike path. He suggests a 25-basis-point hike should be discussed in July. This is a clear deviation from Jerome Powell’s plan, which, along with US strong retail sales data and a speech by the Fed Chairman, supported the growth of the US stock indexes and the EURUSD correction up.

Dynamics of US retail sales

Jerome Powell said that although one will not find examples in the history books when, under conditions similar to today, the Fed managed to execute a soft landing, he and his colleagues are ready to be the first to do it. Looking at the steep fall of the S&P 500 in April and May, financial markets overestimated the risks of a recession. If the regulator manages to avert the recession, the US stocks can well rise, according to JP Morgan. Investors could interpret Powell’s speech as a kind of return to the ‘Fed put’ strategy, which means the market belief that the Fed would step in and implement policies to limit the stock market’s decline beyond a certain threshold.

Implications of a faster monetary tightening by the ECB than expected and a rise in the global risk appetite are not the only drivers for the EURUSD bullish correction. The euro is also supported by the British pound, featuring the best daily rise since 2020 due to the UK’s strong employment data.

Weekly EURUSD trading plan

In general, the euro-dollar correction is natural. I don’t think the opinions of individual ECB and Fed officials are unlikely to change the overall strategies of central banks. Furthermore, the stock indexes will hardly recover unless there are clear signs of an inflation slowdown. Therefore, I suggest selling the EURUSD if the euro fails to consolidate above $1.053 or rebounds from resistances at $1.061 and $1.0665.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.