Haste makes waste. Central banks are in no hurry to cut the rates. The ECB will hardly announce active changes in its policy at its March meeting. Expectations for the interest rate remaining at the current levels support the EURUSD growth. Let us discuss the Forex outlook and make up a trading plan.

Weekly Euro fundamental forecast

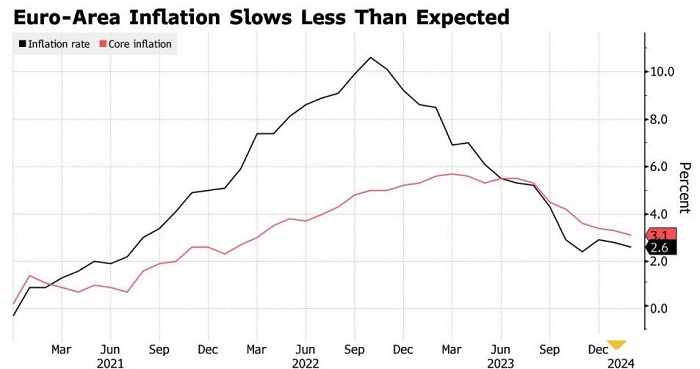

If the stock market is ruled by Greed, then the keyword for Forex is Caution. A rate cut in 2024 is a must, but the more cautious the central bank is, the better for its currency. In this regard, the persistence of European services inflation and a slower-than-expected decline in consumer price growth prompt the ECB to think twice before cutting its deposit rate by a quarter point. As a result, the derivatives market reduced the expected scale of monetary expansion this year to 75 basis points, which encouraged the EURUSD bulls.

In January, the euro-area CPI slowed from 2.9% to 2.6%, core inflation – from 3.3% to 3.1%, and services inflation rate declined from 4% to 3.9%. Markets understand the ECB’s concerns about the sustainability of price pressures, while Commerzbank sees core inflation stabilizing at 3% over the long term as a strong labor market and high wage growth push up costs, especially in the labor-intensive service sector. Earlier, the March meeting of the European Central Bank was seen as a bearish factor for EURUSD due to concerns about lower inflation forecasts; nonetheless, this is not the case now.

Of course, the ECB doves will argue that too high rates are pushing the euro area into a recession, but the position of the hawks is strong. They see many risks of a new peak in inflation, including rising real wages, easy financial conditions, and the return of supply disruptions due to Houthi attacks on ships in the Red Sea.

In the US, there is actually much more reason to expect high prices to return. Along with the above, these include migration, workforce flexibility, soaring productivity due to artificial intelligence and work-from-home technologies, and, most notably, a strong economy. Consumers are actively spending money, and companies are opening new and growing old businesses, GDP is growing by 3.1%, which is significantly higher than the long-term trend of 1.8%. In such an environment, can monetary policy be considered contractionary, as the Fed calls it?

It is obvious that the central bank knows and evaluates all existing risks. It should be cautious. Jerome Powell, in his speech to Congress, will certainly stick to a cautious attitude. However, no matter what FOMC officials say, the central bank’s final actions depend on the incoming data. The US February jobs report might send the EURUSD down.

Weekly EURUSD trading plan

Thus, this week will be extremely important for the major currency pair. The ECB meeting, the speech of the Fed Chairman on Capitol Hill, and the US jobs report can clarify the EURUSD future trend. If the price breaks out the resistances at $1.0855 and $1.0865, the euro could soar above $1.09, but the rally potential looks limited.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.