The EURUSD closely approached the psychologically important level of 1.05 after a nearly 8% rally. Is this enough to satisfy the appetite of speculators? Let’s discuss the topic and make up a trading plan.

Weekly Euro fundamental forecast

When everyone is buying, there is a great opportunity to enter sales. In early November, I wrote that major players took advantage of this opportunity when a strong US October jobs report caused the dollar to strengthen and then decline. This time it happened with the euro. The slowdown in US producer prices from 8.4% to 8% in October allowed the euro to closely approach the psychologically important level of $1.05, but then the sellers stepped in.

The EURUSD November rally is based on several factors. First, a Republican victory in the midterm elections could have reduced the possibility of massive fiscal stimulus during an expected recession in 2023. As a result, US exceptionalism was under attack. Secondly, rumors about Russia-Ukraine negotiations were perceived as a de-escalation of the conflict, which reduced the demand for the US dollar as a safe-haven asset. Third, warm weather and falling gas prices reduced the chances of a long and deep recession in the eurozone. Fourth, there are chances for opening up the Chinese economy and canceling the COVID-zero strategy. Fifth, the slowdown in US inflation made it possible to expect the Fed to slow down its pace.

In the second half of November, it became clear that the euro’s future is not so bright. The final results of the midterm elections have not yet been published, but it is already clear that the Democrats did not suffer a crushing defeat but won. The fall of Russian-made missiles in Poland can be seen as an escalation of the armed conflict in Ukraine. With COVID cases in China rising to 19609, the highest since April, the country’s economy is unlikely to open. If a cold snap occurs in Europe, the EURUSD rate risks falling sharply.

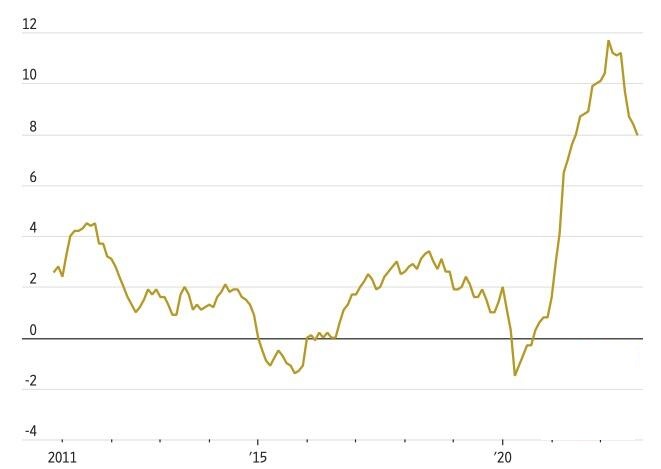

Moreover, the largest USD sell-off since 2008-2009 and the fall in the treasuries yield, together with the S&P 500 rise by 5.5%, significantly weakened financial conditions. This will contribute to domestic demand growth, undermining the Fed’s efforts to fight inflation. The Fed will become more hawkish soon, which is good news for the USD.

Most likely, Fed officials will announce short-term sales. The macroeconomic situation has changed. Inflation and central banks, led by the Fed, are slowing down. Peak rate expectations are falling, as are the chances of a deep and long recession. In such conditions, the US dollar will no longer be a favorite on Forex.

Weekly EURUSD trading plan

Traders are satisfied as they made good money on the November EURUSD rally. In this regard, use the euro decline below the supports at $1.033 and $1.027 for entering short-term sales.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.