The EURUSD fate depends not only on monetary policy and the dynamics of US stock indices but also on China’s ability to beat COVID-19. Let’s discuss the topic and make up a trading plan.

Weekly Euro fundamental forecast

The S&P 500 has risen by 13% since October 12, and the PBoC reduced required reserves by sending about $70 bn into China’s banking system, while the ECB hawks insist on a 75 bps increase in the deposit rate in December. Despite the abovementioned factors, EURUSD failed to consolidate at 1.04. There was too much optimism in the market.

According to 50% of professional investors participating in the MLIV Pulse survey, stagflation with high prices and sluggish economic growth in the global economy will continue in 2023. In 2022, such conditions contributed to the USD strengthening. Therefore, it looks surprising that almost 70% of respondents believe that the USD exchange rate will decrease in a month. This contrasts with the 62% chance of the dollar strengthening a month ago.

Investors made a mistake with the previous forecast and changed sides to become EURUSD bulls. However, there is no guarantee that after a month they won’t turn bearish. As I noted in the previous article, the pair will fluctuate strongly in the coming months.

Don’t be confused by the S&P 500 rally. According to FactSet, according to a report of 97% of companies whose shares are included in the stock index, corporate profits rose by 2%. This is the lowest figure since the third quarter of 2020, which is in line with Wall Street analysts’ forecasts. They expect it to decline by 2% in the fourth quarter. Together with the slowdown in US economic growth and the continuation of the Fed’s monetary restriction cycle, this deprives the market of growth opportunities. However, there is no basis for a rally, according to Aspiriant.

Despite new monetary stimulus in China, the authorities are unlikely to increase bank lending, as the demand for borrowed resources remains low. In addition, mass protests due to the Covid Zero policy are scaring investors, restoring their interest in safe-haven assets such as the US dollar.

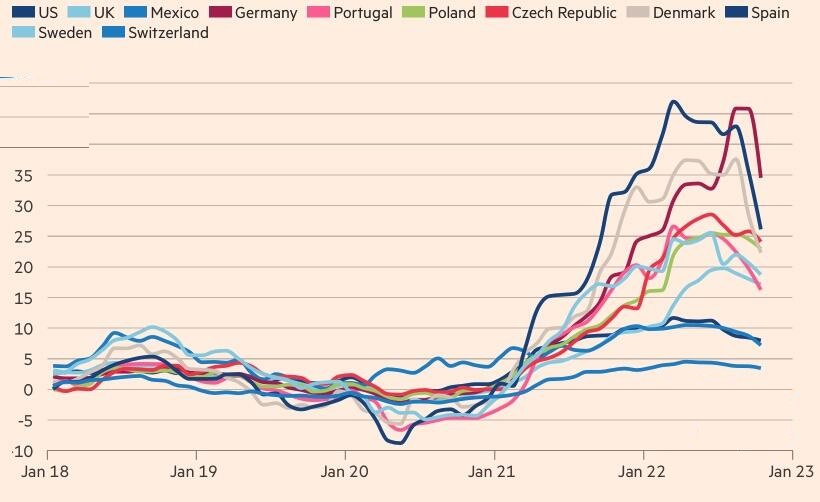

The ECB’s hawks, which have dominated the Governing Council for the past few months, are demanding a 75 bps deposit rate increase in December. However, dovish sentiment is starting to recover. ECB chief economist Philip Lane claims that many of the arguments for such a broad move are no longer relevant. Public discussions indicate a split within the central bank. The release of November inflation data in the eurozone should clarify the situation. Bloomberg experts’ forecast about its slowdown from 10.6% to 10.4% strengthens EURUSD bears. Moreover, according to producer prices, global inflation has already passed its peak.

Weekly EURUSD trading plan

It would not be a surprise if, under such changing conditions, the US dollar takes the lead. A breakout of support at 1.033 will allow to add up to EURUSD short trades entered at 1.038.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.