The EURUSD bulls had expected hawkish signals from the December ECB meeting’s minutes and got them, but Christine Lagarde spoiled the party. Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

The ECB currently works according to the principle of not interfering. Trying to speed up sluggish inflation, central banks have cut rates to zero levels over the past 20 years and expanded their balance sheets to previously unimaginable proportions. The European regulator was at the forefront. Its deposit rate fell to -0.5%, and its balance sheet rose to €8.5 trillion, four times more than in 2015. So why cut monetary stimulus when a surge in inflation could be temporary? What is the point of resisting the global trend if it has finally allowed the ECB to achieve its goal?

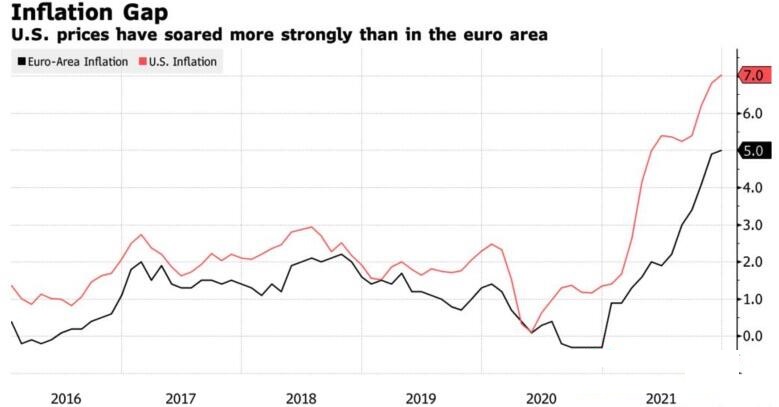

When Janet Yellen, the former Fed Chair, still believes that US consumer prices will fall to 2% by the end of the year, why shouldn’t Christine Lagarde also take a similar view? Moreover, inflation in the USA is growing faster than in the euro area. Lagarde noted this difference, emphasizing that the European Central Bank has every reason not to act as quickly and aggressively as the Fed intends.

According to Lagarde, raising rates too quickly could hamper the euro-area GDP growth, and the US economy is recovering faster than the euro-area. However, the ECB president noted that she had already begun to respond and was ready to continue making adjustments to monetary policy if figures, data, facts required it. The last phrase seems to be intended to calm down the Governing Council hawks. According to the ECB December meeting minutes, they resisted the expansion of the former asset purchase programme by €20 billion per month to offset the impact on the economy of emergency QE, which will be completed in March.

Thus, the position of the European Central Bank is clear. It does not intend to raise rates in 2022, as Governing Council member Pablo Hernández de Cos reiterated. Such a position contradicts the signals of the derivatives market, which is betting on a 20 basis points increase in the deposit rate by the end of this year. Furthermore, the European bond yields rose, which, according to Christine Lagarde, means investors’ confidence in the euro-area economy’s strength.

What I want to note is that the ECB and the euro are political projects. The European regulator is doing what other central banks are not doing – keeping the bond yields of the euro-area peripheral countries at a low level. Otherwise, their governments can get out of the currency bloc, destroying the entire system. This is especially acute in the context of the rapid growth of debt due to the pandemic.

The ECB’s policy of maintaining low borrowing rates widens the US-Germany bond yield spread due to the Fed’s willingness to act aggressively. This circumstance is another argument for the EURUSD downtrend continuation.

Weekly EURUSD trading plan

Therefore, despite the euro best rise over the past six years, any EURUSD price surges are only corrections that should be used to sell the pair towards 1.127, 1.122, and lower.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.