The EURUSD bulls’ attempt to strengthen and provoke a correction was unsuccessful. The USD looks very strong, while the euro positions are vulnerable. However, the situation in Forex is constantly changing. Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental analysis

The strengthened euro quickly declined. However, the EURUSD bulls do not give up. Two of the three key drivers for the EURUSD downtrend may become less dangerous for bulls soon, while the factor of aggressive monetary tightening has been priced in US dollar quotes.

The main reasons for the EURUSD fall are the following factors. First, the divergence in the monetary policy of the Fed and the ECB. Secondly, the war in Ukraine. The longer it lasts, the more likely the EU will join the embargo on Russian oil. The chances of a recession in the eurozone will also increase. Thirdly, the risks of the victory of the nationalists over the globalists in France. The speeches of Jerome Powell and Christine Lagarde at the IMF and the World Bank meeting once again convinced us of the huge difference in the stances of the US and European regulators.

The chairman of the Fed noted that now the central bank needs to act faster than in the past. The US regulator needs to raise the federal funds rate by 50 basis points and wind down the $9 trillion balance sheet. As for the financial markets, they generally react adequately to the events taking place. Let me remind you that CME derivatives signal two consecutive big moves by the Fed.

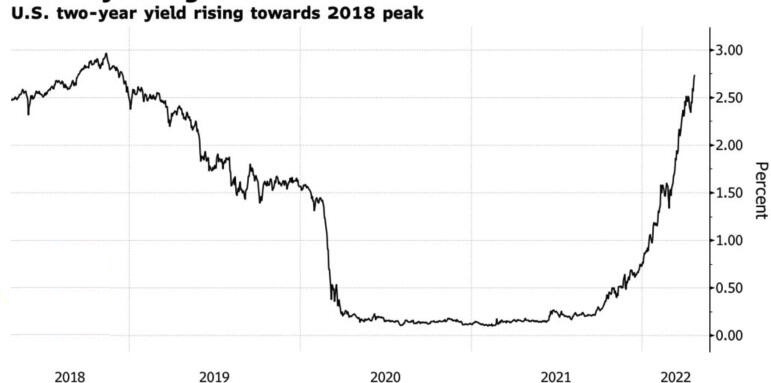

Following Jerome Powell’s hawkish speech, monetary policy-sensitive 2-year Treasury yields soared to 2.76%, the highest level since late 2018, while 10-year bond rates approached 3%. As a result, US stock indices and EURUSD lost all progress and closed the day in the red zone.

Comments from ECB officials caused the initial euro hike. Luis de Guindos said the central bank could raise rates early in the third quarter. Martins Kazaks argued that inflation is at a level that requires action, while Pierre Wunsch said that rising borrowing costs above zero should be a simple matter. As a result, money markets raised the chances of increasing the deposit rate by 75 basis points by the end of the year.

Christine Lagarde’s speech discouraged euro buyers. She noted that tightening monetary policy will depend on the data and underlined the huge difference between the Fed and the ECB.

Treasury Secretary Janet Yellen said a total ban on Russian oil imports is highly problematic as it would raise the price and cost of Russian oil exports. At the same time, opinion polls show that Emmanuel Macron will beat Marine Le Pen by 10% in the second round.

Weekly EURUSD trading plan

Thus, despite the euro fall, the situation is not critical. The victory of the globalists over the nationalists in France, the absence of a recession in the eurozone, and the divergence in the monetary policy of the Fed and the ECB, priced in the EURUSD quotes, can help the pair strengthen. If the euro does not fall below $1.075 soon, the recovery of the downtrend will be doubtful. Hold shorts formed in level 1.092.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.