Will the EURUSD downtrend resume? How deep could the euro fall? Just as the US dollar rose last year on expectations of a rate hike in 2022, the euro may also be rising this year. Let us discuss the Forex outlook and make up a trading plan.

Quarterly US dollar fundamental forecast

The last week of January should be really busy. Investors are anticipating the US and the euro-area PMI data, the outcomes of the Fed’s meeting, as well as the reports on the GDPs, personal consumption expenditures price indexes, and the reporting of large technology companies, whose Nasdaq Composite index marked the largest weekly drop since the pandemic started. The greenback is not rising in a positive environment, and investors wonder if the Fed will give a hawkish surprise.

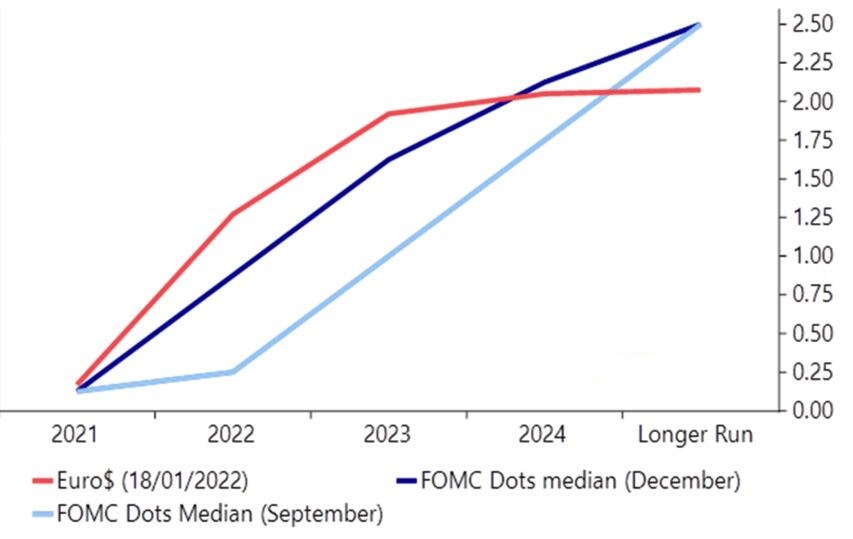

It doesn’t seem likely at first glance. The CME derivatives are betting on the first federal funds rate hike in March, and expect to see it rise at four FOMC meetings in 2022. The Fed will end the QE in early spring and begin to unwind the balance sheet in the third quarter. These are the market forecasts. If Jerome Powell and his colleagues meet the expectations at the January meeting, EURUSD bears will hardly go ahead. The dollar buyers will be encouraged only if the Fed gives a hawkish surprise.

What I am driving at? Some analysts suppose the Fed could hike the interest rate not by 25 basis points but by 50 basis points, which hasn’t happened since 2000. Investors speculate that keeping inflation high could force the Fed to tighten monetary policy not just quarterly, as it did in the previous cycle, but at every FOMC meeting. This hasn’t happened since 2006.

Finally, the Fed could finish the QE ahead earlier than expected, which would open the door not only to higher borrowing costs but to an earlier balance sheet unwinding. According to Deutsche Bank, the Fed’s balance sheet will decrease by $560 billion in 2022 and by $1 trillion in 2023, which is equivalent to 2.5-3.5 rate hikes by 25 basis points.

The Fed’s hawkish surprise could well strengthen the dollar, but will the EURUSD drop to 1.1 and lower? Nordea Markets believes so and expects to see the major currency pair at 1.085 by the end of 2022 amid four rate hikes this year and another four ones next year. JP Morgan Asset Management, on the contrary, argues that traders should buy out the euro drawdowns below 1.13. Allegedly, the expectations of the ECB rate hike in 2023 will make the European Central Bank a more significant figure in Forex than the Fed, and lay the foundation for the EURUSD rally.

A serious risk for the greenback, in my opinion, is that the USD index typically peaked at the time of the first Fed hike and then the trend became mixed or bearish. This explains why the US dollar isn’t rising amid a favourable environment in 2022, and hedge funds were selling off the USD in the week ended January, 18, most actively since mid-2020.

Quarterly EURUSD trading plan

I believe the EURUSD is likely to go below the lower border of the consolidation range of 1.122-1.138. However, if the bulls consolidate the price at support levels of 1.115 and 1.11 the downtrend could turn up.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.